The global ceiling fan market size was USD 14.6 billion in 2025 and will grow at an 8.1% CAGR between the years 2025 and 2035. The valuation will be USD 31.6 billion by the year 2035. One of the prime drivers fueling this growth includes the increasing need for cost-efficient and energy-conserving air-circulating products, particularly in tropical and hot nations. With an emphasis on energy conservation, the integration of smart technologies into traditional appliances is further boosting demand. Its promotion by accelerated urbanization and a boom in residential and commercial property development is boosting growth.

Residential electrification and increasing affordability for upscale domestic appliances are surging in fast-developing Asian and African economies. These socioeconomic forces are expected to continue to speed international penetration by high-tech fans with Wi-Fi, remote-control access, and voice-assistant capabilities.

The rise in temperature fluctuations and longer summers in most parts of the world are causing individuals to become more dependent on inexpensive cooling devices. Unlike air conditioners, roof fans have continuous airflow with minimal power consumption, hence making them an eco-friendly option for green consumers. This reality is boosting their popularity among urban and rural dwellers alike.

The design innovation in motors and blade efficiency is creating new opportunities for expansion. Firms are focusing on noise reduction, appearance and feel, and home automation compatibility to address evolving consumer desires. The inclusion of features such as LED lighting, inverter motors, and reversible airflow helps to stay in the competition.

While traditional fans dominate, the high-end and intelligent fan segments are gaining momentum. Leading players are targeting the mid-income group customers with value-for-money propositions that combine technology and energy efficiency. Thus, the industry is set to witness vibrant growth over the forecast period, driven by robust macroeconomic conditions, weather conditions, and shifting customer preferences.

Explore FMI!

Book a free demo

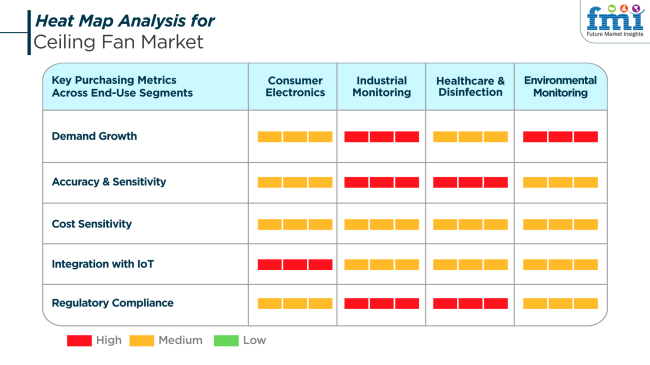

The demand is evolving with the increasing adoption of smarter, more efficient technology. In consumer electronics, consumers desire designs that support interior beauty without sacrificing smart connectivity. The growing penetration of smart homes is fueling strong growth in demand and embracement of IoT-enabled features.

In industrial monitoring applications, very high demand growth and a need for precise performance standards define buying. In these cases, durability and compliance with regulations are important. Similarly, disinfection and healthcare use favor hygiene, noise reduction, and reliability, with high sensitivity to the consistency of airflow. Environmental monitoring uses fans with consistent performance in various climates, where energy efficiency and IoT connectivity facilitate support for sustainability initiatives. In all these sectors, cost sensitivity remains high in industrial and environmental uses, pressuring vendors to deliver value-focused yet performance-driven solutions.

The industry is faced with an array of upcoming risks that are mostly related to regulatory pressure, fluctuating raw material prices, and technology disruption. With governments all over the world implementing tougher energy efficiency standards, manufacturers are forced to undertake continuous investment in R&D so that they remain compliant.

Non-compliance with these new standards can lead to restricted access or product recall. Raw material price volatility, especially metals like aluminum and copper used in fan manufacturing, impacts margins and the cost of production directly. This is more so in developing nations where manufacturers are operating on thin margins. Exchange rate volatility also raises cost predictability, especially for exporters.

The rapidly expanding pace of smart home technology also presents a competitive threat to several manufacturers. Companies that do not adopt the trend toward smart, app-controlled, and sensor-equipped devices risk becoming obsolete. The expanding trend of multifunctional cooling appliances also presents substitute threats.

Between 2020 and 2024, the industry saw steady growth, driven by the demand for energy-efficient and aesthetic solutions in both residential and commercial spaces. Technological advancements, such as the introduction of smart fans with remote control, increased the appeal of roof fans, especially in tech-savvy consumer segments. The increasing awareness of energy conservation and the need for efficient air circulation also contributed to growth.

During the forecast period 2025 to 2035, the market is expected to experience significant advancements. The integration of IoT connectivity and advanced smart technologies will become a dominant trend. In addition, energy-efficient models will continue to grow in popularity as consumers increasingly prioritize sustainability. Furthermore, the demand in emerging regions will rise due to urbanization, infrastructure development, and increasing disposable incomes.

Comparative Market Shift Analysis: Ceiling Fan Market 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus : Emphasis on energy-efficient, aesthetically pleasing solutions for residential and commercial use. | Technological Integration : Introduction of smart fans with IoT connectivity, remote control, and advanced features. |

| Consumer Demographics : Primarily residential consumers and some commercial sectors. | Expanded Demographics : Increased adoption by both residential and commercial sectors, especially in emerging markets. |

| Key Drivers : Growing demand for energy efficiency, aesthetic appeal, and increased awareness of sustainability. | Smart Technologies : Integration of IoT, voice control, and automation to enhance convenience and energy savings. |

| Sustainability Efforts : Focus on energy-efficient models that reduce electricity consumption. | Sustainability Innovations : Continued growth in energy-efficient and eco-friendly fans using sustainable materials. |

| Regional Focus : Strong demand in North America and developed markets, with increasing growth in emerging economies. | Global Expansion : Higher adoption in emerging markets due to urbanization, infrastructure development, and increased disposable incomes. |

The USA would grow at 4.9% CAGR throughout the forecast period. The growing need for energy-efficient appliances and higher customer demand for smart home connectivity are majorly propelling demand for advanced ceiling fan systems in residential and commercial spaces. Roof fans are quickly accepted with the latest features like remote control, timers, and energy-efficient motors. Supportive government standards for energy efficiency and replacement demand for old, conventional ventilation equipment fuel growth on a sustained basis.

Even commercial segments like retail, education centers, and hotel/restaurant/lounge segments are augmenting demand thanks to budget-sensitive climate-control measures. Technological advancements and compatibility with home automation systems establish roof fans as a viable alternative or complement to HVAC systems for energy-efficient households. The rising need for decorative and utility fans for high-end residential developments further accelerates performance in urban regions.

The UK is anticipated to expand at 3.8% CAGR over the forecast period. In spite of the temperate climate of the country, the growing emphasis on energy conservation and indoor air circulation is fueling demand.

The industry has witnessed increasing demand for trendy, space-efficient ventilation options, particularly in urban homes where energy efficiency is of utmost importance. With energy costs varying and sensitivity to sustainability on the rise, more businesses and households are relying on roof fans to complement central air systems.

The residential segment has registered growth in the installations, especially in multi-apartment buildings and housing societies that are being modernized. Furthermore, commercial areas are embracing roof fans to ensure air circulation without substantially increasing energy bills. Stepped-up import of design-oriented fans and product customization is also pulling in the consumer base, particularly fashion-conscious consumers.

France will grow at a 3.5% CAGR over the study period. The region enjoys the increasing need for low-energy cooling options amidst increasing environmental awareness. Driven by a strong interest in sustainable lifestyles, French customers are seeking options for air conditioners, creating a steady penetration in consumer and commercial spaces.

Growing trends toward minimalist and modern designs also stimulate the deployment of aesthetically appealing fans. Businesses and homeowners alike are increasingly incorporating fans amid rising summer heatwaves, which are occurring with greater frequency. Moreover, government legislation regarding energy usage and thermal convenience in buildings indirectly promotes the integration of roof fans as auxiliary devices for cooling.

Retail and accommodation industries are embracing ornamental fan units that appeal to architectural interior schemes while staying comfortable. Diversified France's realty portfolio and intensifying renovation business support ongoing opportunities for expansion and entry with high-end as well as economical fan providers.

Germany is likely to expand at 3.6% CAGR throughout the analysis. With a strong engineering industry and a high inclination towards energy-saving appliances, Germany offers a receptive region for efficient fans. Customers are becoming interested in higher-end fan models that provide noiseless operation and multi-speed modes. With home constructions increasingly aimed at energy optimization, roof fans are emerging as efficient means for indoor air management.

Current climate trend shifts, such as extended summer seasons, have prompted households and public facilities to invest in budget-friendly, non-air conditioning products. Roof fans are being included in newly constructed green buildings as well as reconstruction projects, particularly those with passive cooling strategies incorporated.

The increase in demand for the hospitality and office spaces industry is also pushing growth. Integration with smart systems, such as mobile control and programmable timers, is increasing appeal among technology-conscious consumers. Germany's framework and regulatory system continue to foster the uptake of effective ventilation products.

Italy will grow at 3.4% CAGR over the study period. Italy is experiencing a slow shift from conventional cooling systems to hybrid ventilation solutions because of the increased emphasis on energy-saving and design innovation. Beauty is a major consideration in consumers' choices, with growing demand for designer and vintage-style fans that blend well with the Mediterranean architectural style.

Urban consumers increasingly prefer roof fans for bedrooms, living rooms, and covered porches where ceiling clearance and visual coherence are of particular importance. Moreover, increasing refurbishment of historic buildings into boutique hotels and rental properties has driven demand for quiet, efficient, and visually integrated fan solutions.

Ceiling fans are also gaining acceptance in non-domestic structures to assist with thermal comfort at a fraction of the cost and environmental impact of air conditioning. Even with a relatively low growth rate, product differentiation and increasing public concern regarding environmentally friendly ventilation options remain to bolster long-term potential in Italy.

South Korea will grow at a rate of 4.2% CAGR through the research period. Urban and suburban regions are being spurred by increasing demand for energy-aware architecture and in-house comfort solutions. South Korea's robust tech infrastructure and upscale customer expectations from smart home connectivity are driving the pace of innovation. High-end models featuring IoT technologies and remote controlling functionalities are catching quick popularity with smart consumers.

There are increasing residential real estate projects, particularly high-rise apartments, where ceiling fans are employed as an addition to centralized air-conditioning systems. Furthermore, the hospitality and retail industries are now more inclined towards adopting ceiling fans for comfort as well as appearance.

Government campaigns for energy-saving building solutions, as well as incentives for consumers purchasing energy-saving appliances, are supporting favorable conditions. As increasing numbers of consumers turn to non-intrusive, low-noise cooling options, roof fans are taking their place as functional and fashionable additions in contemporary Korean dwellings and commercial spaces.

Japan will grow at 3.9% CAGR over the study period. Urban households in Japan drive demand for ceiling fans due to their need for compact, multifunctional appliances that are energy-efficient and aesthetically pleasing. The popularity of space-efficient architecture and minimalist interior design in residential spaces has enhanced the appeal of ceiling fans as quiet and space-efficient ventilation systems.

Advanced technology and automation are highly valued among Japanese consumers, and this consumer behavior is also seen in the growing demand for fans with functionalities such as occupancy sensors, variable speed control, and mobile connectivity. Climate variability by season, such as hot and humid summers, makes roof fans a credible companion or alternative to air conditioners.

Further, old suburban infrastructure is being retrofitted with energy-efficient upgrades, and this creates an opportunity for ceiling fan vendors to grow. The business segment, including healthcare and hospitality, also appreciates the functionality of ceiling fans in keeping people comfortable with reduced operating expenses.

China will grow at 6.1% CAGR throughout the study. China has the fastest-growing demand for ceiling fans, led by its huge construction industry and fast-urbanizing population. With continuous infrastructure development and a high priority on sustainability, ceiling fans are being increasingly used in both commercial and domestic settings.

The trend for high-efficiency appliances, especially in tier-1 and tier-2 cities, fits perfectly with the energy-saving features of new-generation ceiling fans. Companies are taking advantage of smart home connectivity and mobile-operated systems to address the digitally connected Chinese consumer.

The growing middle class and increasing disposable income have also driven demand for high-end ceiling fan models with stylish designs and multifunctional capabilities. The real estate boom, combined with national objectives for carbon emission reductions, is creating a favorable environment for expansion. Moreover, the export competitiveness of local manufacturers enables ongoing innovation and cost competitiveness in domestic and international markets.

The Australia-New Zealand region will grow at a 4.0% CAGR throughout the study. Warm weather in the area and the growing concerns about energy usage have contributed to the popularity of ceiling fans as an efficient option for both residential and commercial use. The ever-increasing need for cost-cutting and environment-friendly cooling products has been the primary growth driver, especially among suburban housing complexes and hospitality properties.

In Australia, ceiling fans are commonly used in combination with passive design strategies to minimize the use of air conditioning. New Zealand is witnessing similar trends in sustainable new home construction and retrofitting programs. It is supported by public campaigns promoting energy-efficient products, coupled with government rebates.

Product innovation, such as remote-control capabilities and dual-function fans with lighting, has enhanced consumer attitudes toward ceiling fans as both functional and decorative. The continuing housing expansion and modernization activities in both nations continue to provide favorable conditions for consistent development.

In 2025, the ceiling fan market will be led by decorative fans with a share of 35.5%, while traditional fans will hold 30.2%.

Demand for decorative fans has increased. Decorative fans usually feature designs covering everything from basic outlines to complex patterns and colors offered by a variety of materials to chic finishes that meld effortlessly into the home décor, particularly focal points in modern and luxury settings. A growing number of consumers want functional decorative fans that can be used in the home or office.

Famous brands like Hunter Fan Company and Casablanca design fans with features such as built-in lighting, smart control systems, and energy-efficient designs that appeal to homeowners. The increasing trend of smart homes is another aspect that favors the acceptance of decorative fans, which can be integrated into home automation systems. A case in point would be the Hunter Symphony Fan, marketed as a sleek-looking fan that incorporates Wi-Fi into its functionality. It thus appeals to both the technologically savvy and the aesthetically inclined consumer.

The traditional segment controls 30.2% of the industry due to their reliability and cost-effectiveness in cooling and ventilation. Traditional fans are mainly suited for budget-oriented regions with an outright need for basic air circulation. These fans are basic ones compared to decorative models and probably have fewer features, but they are favored due to their durability and cost. Top brands like Minka Aire and Emerson supply traditional fans that focus on less installation involvement, easy maintenance, and sheer functionality.

By size, medium-sized fans occupy 52.5% of the share, and small-sized fans will follow to take up 22.4%.

Medium Fans are often preferred for residential and commercial applications. They can fit many room sizes and are mostly used in living rooms, kitchens, and bedrooms, as well as in medium-scale commercial spaces. Ideal for effective circulation in the room without compromising goodness or requirements for airflow and aesthetic value, comes a medium fan. It comes from leading manufacturers like Hunter Fan Company and Casablanca in various styles, from traditional to modern designs; here lies.

Integrating energy-efficient motors, quieter operation, and variable speed control features are what appeal to these fans and many customers as a fundamental need above comfort. For example: "Hunter Symphony," a medium-sized fan, comes with smart technologies that have made it popular among homeowners who want to automate their lives.

Small-sized Fans are still necessary for certain uses. These are the fans that are used in very small rooms, like small bedrooms, bathrooms, or offices, that take up a small part of the space. Effective in providing fresh air into an area but keeping a compact profile and blending almost into the room without being conspicuous.

This trend is largely boosting small fan popularity among apartments and tiny homes that have limited office space and a relatively small urban footprint. Companies such as Minka Aire and Emerson will come out with new small fans made with very innovative designs to save space and energy and cater to the trend toward minimalism.

The industry is competitive, and traditional brands utilize technological innovation, energy efficiency, and aesthetics to gain a large share. Crompton Greaves continues its dominance by showcasing high-quality, energy-efficient ceiling fans. Emerson Electric Co. is strong and has a brand reputation for being durable and quiet, and NuTone has established a niche with smart-home-integrated ceiling fans. Hunter Fan Company stands in place boldly with fashionably stylish and productive designs, while Shell Electric MFG Co. Ltd. offers cost-effective solutions to price-conscious customers.

Big Ass Fans, who also possess the largest industrial share with high-performance, high-volume fans. Other large players like Ajanta Electricals and Del Mar Fans & Lighting are picking up pace in niche segments with value-for-money and energy-saving home-use products. The industry is dynamic, too, with constant innovation in motor technology, blade design, and smart home integration propelling consumer demand. The companies are also aggressively seeking energy conservation and sustainability, further boosting growth.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Crompton Greaves | 18-22% |

| Emerson Electric Co. | 12-15% |

| NuTone | 10-12% |

| Hunter Fan Company | 8-10% |

| Shell Electric MFG Co. Ltd. | 7-9% |

| Other Players | 30-35% |

Key Company Insights

Crompton Greaves leads with an 18-22% share because of its deep tradition of energy-efficient and high-quality products and extensive reach of distributors. Its wide range of products, from cosmetics to high-performance fans, guarantees its leadership in the home as well as business-to-business industries.

Emerson Electric Co. takes the second spot with a 12-15% share, widely recognized for its focus on energy efficiency and long life. Its advanced motor technology and addition of silent operation design to residential and commercial fans have enhanced its competitive position.

NuTone dominates 10-12% share with new, smart home-integrated designs that are attractive to customers looking for style and functionality. Hunter Fan Company holds 8-10% share with energy-efficient fans of conventional designs, and Shell Electric MFG Co. Ltd. holds 7-9% with affordable solutions in home and commercial markets.

Big Ass Fans leads the industrial segment with a 6-8% share because of demand for high, heavy-duty fans. Ajanta Electricals (5-7%), Del Mar Fans & Lighting (4-6%), and Mega Home Appliances (3-5%) are the runners-up, occupying a niche market with low-cost and energy-saving offerings.

The industry is slated to reach USD 14.6 billion in 2025.

The industry is predicted to reach a size of USD 31.6 billion by 2035.

Key companies include Crompton Greaves, Emerson Electric Co., NuTone, Hunter Fan Company, Shell Electric MFG Co. Ltd., Big Ass Fans, Ajanta Electricals, Del Mar Fans & Lighting, Mega Home Appliances, and The Henley Fan Company Ltd.

China, slated to grow at 6.1% CAGR during the forecast period, is poised for the fastest growth.

Decorative fans are being widely used.

The segmentation is into Standard and Decorative.

The segmentation is Small, Medium, and Large.

The segmentation is into Residential and Commercial.

The segmentation is into Offline and Online.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.