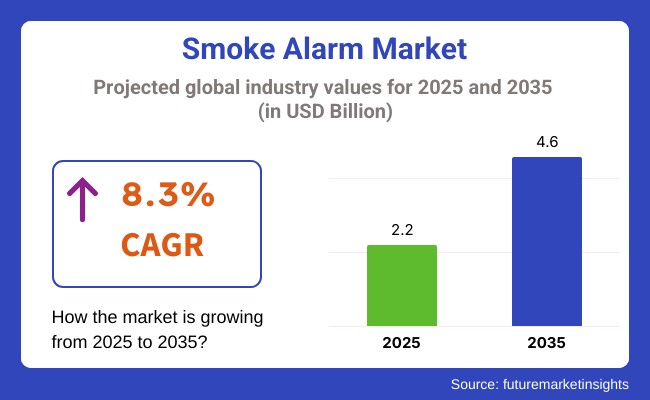

The smoke alarm market is set to witness substantial growth in the coming decade, driven by growing fire safety concerns, mounting regulatory demands, and consumer awareness. Estimated at around USD 2.2 billion in 2025, the market is expected to grow beyond USD 4.6 billion in 2035, at a strong CAGR of 8.3% through the forecast period.

One of the key drivers of growth in the industry is the growing adoption of strict fire safety regulations in residential, commercial, and industrial segments. Governments and fire safety organizations globally are implementing the installation of smoke detection and alarm systems in new and old infrastructure to reduce fire-related injuries, fatalities, and property damage. This regulatory drive has been particularly evident in cities, where the threat of fire accidents is greater because of population density and high-rise development. Technological innovations are also transforming the industry.

Today's systems come with features like wireless connectivity, compatibility with smart home environments, battery level notifications, and even app-based alerts on smartphones. Such smart smoke alarms are more functional and convenient and hence appealing to a digitally conscious consumer base. With IoT-enabled smart home products spreading rapidly, connected fire safety solutions will find increased demand, driving further growth in the industry.

Further, the increasing pace of urbanization and rapid infrastructure growth, especially in emerging industries, is driving the need for smoke detection systems.

Asian-Pacific nations, Latin nations, and regions of Africa are all witnessing widespread growth in the construction industry, thus fueling the application of fire prevention and detection systems. Domestic consumption, especially in newly constructed multi-unit apartment complexes and single-family dwellings, accounts for a massive share of demand. Thus, offices, shopping malls, and hotels are increasingly embracing advanced systems as part of their conformity to safety requirements as well as a risk avoidance investment. However, industry penetration is being deterred by some of the issues, including the costliness of installing and keeping complex systems, particularly in price-sensitive industries.

Moreover, relentless false alarms and routine battery replacement demands can be an intervening variable in user adoption and trust, particularly among elderly groups who are technology illiterate. Nevertheless, the future for the global industry is highly promising.

Industry players are emphasizing product innovation, intuitive products, and strategic partnerships as a vehicle to grow their presence globally. Acquisitions and mergers, especially of fire safety equipment producers with tech firms, are also on the rise to enable bundled safety packages that are scalable and effective.

Explore FMI!

Book a free demo

The industry is driven by evolving safety needs, increasing use of smart home devices, and increased public awareness of fire hazards.

Producers focus on offering equipment with high performance, ensuring accurate detection, durability in construction, and compatibility with home automation systems, along with strict adherence to safety regulations. Distributors and retailers, having closer proximity to consumers, stress ease of installation and affordability in a bid to meet various buyers' needs.

Regulatory bodies are concerned with legality and safety, and these alarms are fire safety code compliant across various geographies. Residential and commercial end users are seeking reliable, low-cost, easy-to-use alarms with growing interest in having smart features for remote monitoring and connectivity.

With urbanization continuing and building codes tightening, purchasing decisions are being driven both by usability for function and hi-tech integration, and the industry is becoming more innovative and competitive.

The industry between 2020 and 2024 was led by increasing consumer awareness of fire protection and stricter regulatory standards, particularly in residential and commercial settings. Regulators across the world made it mandatory for the installation of smoke detectors, driving the industry.

Technological improvements, such as the addition of smart technologies like Wi-Fi or Bluetooth communication and dual-sensor technology, helped significantly towards increasing detection effectiveness and convenience to consumers. These devices provided improved performance by identifying different types of fires and sending instant notifications on cell phones. Second, battery-powered detectors were favored since they were easy to install without the use of complicated wiring systems.

Future projections to 2025 to 2035 include further growth with the increasing development of smart homes and the continued emphasis on fire safety. The take-up of home ecosystems will rise, with these alarms being integrated into the wider home automation system.

With increasing urbanization in areas such as Asia-Pacific, demand for fire safety solutions will grow. In addition, developments in AI and IoT technology will allow for predictive warnings and improved compatibility with other home security systems, making it more convenient and safer overall.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory requirements, customer awareness, technology development | Smart home integration, AI-based predictive warnings, increasing urbanization |

| Wi-Fi/Bluetooth-enabled smart alarms, dual-sensor technologies | Networked smart home solutions, predictive and real-time warning systems, increased AI and IoT integration |

| Ionization and photoelectric dual-sensor technologies, battery-powered | AI-based fire detection, predictive fire detection technology, seamless IoT integration |

| Faster growth in North America, Europe, and Asia-Pacific on the back of regulatory needs and rising awareness | Faster growth in Asia-Pacific on the back of urbanization and rising awareness of fire protection |

| Growth in demand for ease of installation, wireless designs, and additional safety features | Increased demand for end-to-end smart home protection solutions that are fully integrated, greater use of mobile apps for monitoring |

| Energy-efficient battery options | Increased emphasis on environment-friendly designs and energy-efficient models |

The industry is evolving progressively due to improved awareness of fire safety, stringent building codes, and smart home technology integration. As a result of the increased demand for secure and advanced fire detection systems, certain risks might have implications for industry development and stability.

One of the major risks is economic sensitivity towards the industry. These alarms, particularly sophisticated ones with smart attributes, are purchase decisions that have been postponed to a later stage. During instances of economic downturn or financial unreliability, consumers and business organizations will put off or revoke investments in safeguard devices. Such diminished spending by the consumers can lead to a slowing of industry growth as well as to the decrease of sales by the manufacturers, especially in industries highly responsive to price.

Disruption in supply chain is a second major hazard. The production relies on advanced global supply chains for the major ingredients of sensors, batteries, and semiconductors. Interruption of such a supply chain-geopolitics, pandemics, or natural disasters-can lead to production delay, higher costs, and unavailability of essential material. These interruptions can lead to stockouts and price instability, affecting manufacturers as well as end-users.

The threat of technology becoming outdated is also present in this rapidly evolving industry. As smart home technologies and Internet of Things (IoT) solutions become increasingly integrated into the lives of consumers, connected alarms with attributes such as AI-based detection or interconnectivity with home automation systems will become obsolete sooner or later. Companies that fail to innovate and introduce these new features may lose their customers and business.

Compliance with regulation is another hazard. Different fire safety norms and regulations are implemented in various nations, and their products have to be tailored locally to accommodate norms. Non-compliance can lead to product recall, fines, or banning the sale of a product in some industries. Such regulatory restrictions do not come without cost, including loss of reputation along with financial fine.

Additionally, as more and more options are networked via IoT, the risk of a cybersecurity breach is higher. Connected devices' vulnerabilities could threaten user privacy and safety. If manufacturers do not take steps to address such issues, consumer trust in smart alarms will decline, and regulatory agencies may introduce more stringent security requirements, adding further to the cost of operation.

The industry is threatened by stiff competition and industry saturation. The industry is becoming saturated with established brands and new players selling similar products. Such saturation puts pressure on prices and may result in reduced profit margins, particularly for small or new companies seeking to gain industry share. Companies should differentiate themselves through innovation, brand, and improved quality of products to maintain their industry share.

To fight against these hazards, companies should diversify their supply chains so they are not dependent upon a single region or supplier. Regular investment in research and development will be the key to staying up to date with the latest technologies and consumer preferences. Apart from this, adherence to local regulations, possessing adequate cybersecurity controls, and seeking product attributes or customer support as differentiators will be the key strategies to navigate through any challenges and attain long-term success.

It is anticipated that the industry will be dominated by photoelectric smoke alarms, with a projected 55% industry share in 2025, followed by ionization smoke alarms standing at 25% industry share.

Photoelectric alarms have a great preference over other types because they respond quickly to smoldering fire types that may produce a lot of smoke before there is an obvious flame. Thus, photoelectric alarms are most beneficial in situations such as the home because of their efficacy in kitchens or other relatively high-humidity areas where smoke builds up before flames appear.

Companies like Nest (a Google company) and First Alert are banking on such technology to come up with baseless and quick systems that will get even more connected with modern smart home systems. These alarms are designed to be superior by using light sensors to detect smoke particles, and as such, they tend to avoid false alarms caused by cooking or steam, so they provide more accurate warnings.

Ionization alarms include a small percentage of the products being sold, and they can still detect fast-flaming fires with fewer smoke particles. This type of alarm ionizes the air within the chamber and reacts when smoke particles disrupt the ionization current. They are cheaper and mostly found in older homes or areas with little risk of smoldering fires since ionization alarms only use an ionized air medium in their chamber before detecting smoke. Companies like Kidde and Honeywell continue to provide ionization-based alarms in budget-conscious industries or areas prone to fast-flaming fires.

Each of these technologies would have its benefits depending on the fire risk type in an area. Still, the fact remains that photoelectric alarms are better overall as they provide much better reliability and fewer false alarms. With stricter fire safety regulations, it is expected that the demand for photoelectric alarms will increase much further.

In the year 2025, the industry will truly be from the residential segment for 65% of the share and supported by commercial 30%.

The most significant residential industry continued by increasing fire safety awareness, government regulations, and housing safety codes requiring installation in all houses. As homeowners have begun to look for safer, easier, and more reliable solutions to their fire safety needs, more alarms continue to be sold. The likes of Nest (Google), First Alert, and Kidde take advantage of a trend toward advanced smoke detection systems, such as smart smoke alarms connected to mobile apps and smart home networks for monitoring and alerts from a distance.

Another motivator for the residential market is the fact that there has been an increasing trend in renovations to existing houses and the construction of new homes, especially with fire safety standards becoming stricter over the years.

The commercial part of this industry is indeed much substantially smaller than that of the residential side; nevertheless, it is an important portion of the overall industry. For example, offices, retail establishments, and industrial facilities need smoke detectors in order to comply with safety regulations. Alarms have become increasingly important for environments in which the risk of fire is higher, such as buildings involving electrical equipment or heavy machines and personnel gathering at large.

Honeywell and Siemens are among those companies that manufacture and supply commercial-grade smoke detection systems for applications in larger installations, developed with additional integrated heat sensors and fire alarms in whole building safety management systems.

The technological advances in smoke detection and continued green legislation toward enhanced fire safety standards would pave the way for growth in both residential and commercial segments of the industry in the coming years.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

| UK | 6.7% |

| France | 6.2% |

| Germany | 6.9% |

| Italy | 5.8% |

| South Korea | 7.1% |

| Japan | 5.9% |

| China | 9.1% |

| Australia-New Zealand | 6% |

The USA industry is forecast to develop at 8.3% CAGR throughout the study. The industry growth is stimulated by stringent residential and commercial safety laws, as well as increased public consciousness regarding fire risks.

Insurance requirements and national building codes demand smoke detection system installation, particularly in multi-family residential buildings, schools, and commercial facilities. This regulatory environment plays an important role in the widespread implementation of standalone and interconnected alarm systems. The growing smart home industry is also an important factor driving demand.

Users are increasingly interested in smart smoke alarms that come with mobile notifications, voice control, and automated emergency procedures. Ongoing innovation by top manufacturers is paving the way for dual-sensor and photoelectric alarms with improved reliability.

Furthermore, replacement demand on account of the finite life cycle of conventional smoke detectors sustains regular industry activity. Government spending on infrastructure upgrading also sustains adoption in poor and rural regions, maintaining growth in the various areas.

The UKindustry is anticipated to expand at 6.7% CAGR over the study period. Fire protection is still a top priority in the UK owing to government-supported residential regulations and public health policies. New legislation that requires the installation in rented homes and new residential developments is still a key driver. Increased awareness programs and safety inspections also enhance the need for high-quality smoke detection instruments.

Smart, networked smoke detectors are becoming the choice of preference, especially among urban homeowners with smart home environments. The linkage with home automation systems and mobile alerts provides alertness in time, enhancing safety measures. Growth in the older segments of the population is encouraging more voice-based alarm and visual signal device installations.

Also, retrofitting programs for public housing and commercial establishments provide impetus to industry growth. Energy-efficient equipment with long-life lithium batteries is seeing a growing uptake because of low maintenance needs. The synergy between regulatory compliance and technological advancement puts the UK in line for consistent industry growth.

The French industry is anticipated to develop at 6.2% CAGR over the research period. The industry is dominated by statutory legislation mandating that all residential structures be fitted with smoke alarms. With better compliance, there is a parallel increase in demand for the product in urban and semi-urban areas. Improving public awareness regarding fire safety, fueled by continuous awareness campaigns, has been the key to maintaining this trend.

The spread of interconnected alarm systems is accelerating, especially in multi-family complexes and institutions. Growing acceptance of dual-sensor alarms and systems that can sense smoke and carbon monoxide is noted. Advancements in improving alarm sensitivity, minimizing false alarms, and enabling remote notification are increasingly important buying criteria.

The demand for seamlessly integrated appearance in contemporary interior design has also prompted design innovation and form factor breakthroughs. Generally, a greater focus on intelligent, dependable, and simple-to-install smoke alarms is supporting France's industry trend.

The German industry will grow at 6.9% CAGR throughout the study. Across-the-board legislation that mandates smoke alarms throughout all residential homes has largely influenced the German industry. High rates of compliance in Bavaria and North Rhine-Westphalia show the regulatory influence on customer habits.

Demand for sophisticated fire detection systems has been further driven by energy-efficient building trends and increased safety issues in highly populated urban complexes. These alarms integrated with building management systems are becoming more prevalent in new commercial and multi-unit residential developments.

Consumers have distinct preferences for product longevity, tamper resistance, and absence of maintenance needs. Battery-powered alarms with longer life and wireless interconnection are gaining ground. Technological advances aimed at noise reduction, visual indication, and smartphone-based control also drive wider applications. Sustained metropolitan growth and stricter building codes should contribute to the maintenance of an upward trend for the German industry.

The Italian industry is anticipated to grow at a 5.8% CAGR throughout research. Though adoption has been moderate in the past, residential fire safety awareness is gradually on the rise. Education campaigns, home insurance rewards, and alterations to safety legislation in newly built houses are driving growth. The demand is strongest in cities and areas that are in the process of residential modernization.

The transition to smart homes is starting to affect purchasing habits, with increased demand for networked alarms that provide app-based monitoring and automated emergency notifications. Tourism-supported real estate growth and public infrastructure developments are adding installations in hotels, rented apartments, and commercial buildings.

There is still uneven regulatory enforcement and low awareness levels in rural areas. Despite this, the overall trend is one of a slow but steady uptake, facilitated by technology-driven improvements and growing availability in retail and distribution channels.

The South Korean industry will grow at 7.1% CAGR throughout the study period. South Korea is a lucrative industry due to high urbanization and rigorous government enforcement of safety standards in buildings. Recent fires have raised awareness and increased the stringency of building inspection policies, boosting installation rates in public and residential buildings. The popularity of wireless, compact devices fits the high-rise housing structure that is common in urban areas.

Smart alarms incorporating IoT capabilities are being rapidly adopted, particularly by technologically active consumers who focus on timely alarm triggering and linkage with wider domestic automation systems. Builders of dwellings are now including smoke alarms as standard on base specs of new buildings as well, enhancing demand.

Performance aspects of priority are battery longevity, sensitivity, and suppression of false alarms. Educational initiatives and policy measures are expected to enhance fire preparedness and increase penetration across the industry over the next decade.

The Japanese industry will grow at 5.9% CAGR over the study period. Strict fire safety standards, particularly in urban prefectures, facilitate mass installation on residential and commercial properties. The frequent occurrence of natural disasters and high-density housing environments have made early detection of fires more crucial. Governmental incentives for the retrofitting of existing buildings are anticipated to remain supportive of industry growth.

Japan's growing aged population is also driving up demand for user-friendly featuring audio-visual signals and intuitive control functions. The trend prefers sleek and thin designs that go unnoticed on minimalistic home decor while not sacrificing high-level features. Integration into smart homes remains a small but emerging sector based on young users and city consumers.

Product innovation in the form of smoke heat combination detectors is also penetrating the industry. Despite a deceleration compared to international rivals, consistent consumer concern and product standardization enable solid long-term industry performance.

The China industry is anticipated to increase at 9.1% CAGR from the period under study. Accelerating urbanization, growing disposable income, and stringent government requirements for fire protection in new structures are among the major drivers accelerating the growth of the industry. Extensive development of residential and commercial buildings, particularly in Tier 1 and Tier 2 cities, has intensified the use of fire protection systems. National building codes more often mandate networked alarms in high-occupancy buildings.

Smart adoption by the nation is pivotal for the wide-ranging adoption of enhanced smoke alarms at high speeds. Centralized building management systems, as well as alarms connected with cell phone apps, are highly demanded. Domestic firms use economies of scale to deliver affordably priced products of superior quality, thereby achieving mass consumption.

Fire awareness campaigns and drills, especially among urban dwellers and students in schools, are enhancing consumer fire awareness. Through the decade to come, further urban development and expansion of digital infrastructure are projected to continue fueling solid industry traction.

The Australia-New Zealand industry will grow at 6% CAGR throughout the study period. Both countries have a high priority for fire safety as they are prone to bushfires and demand modern, energy-efficient housing. Its building codes and insurance provisions require alarms to be installed in residential spaces, tested regularly, and replaced with batteries, which are also regulated. These conditions are at the forefront of a constant demand for smoke detection systems.

The industry is slowly shifting towards smart smoke alarms with capabilities like Wi-Fi connectivity, smartphone compatibility, and voice alerts. Customers are increasingly turning to networked alarms that offer coverage across homes and multi-unit dwellings.

Public education campaigns, combined with community-based fire safety programs, also promote proactive uptake. Online shopping platforms are increasing product availability, especially in rural and remote areas. As smart living gains prominence, demand for multifunctional, easy-to-install alarms is expected to grow steadily.

The industryhas been defined by a strong presence of multinational companies with strong brand equity and wide distribution networks. Companies such as Kidde, First Alert, and Honeywell International Inc. have a significant industry share due to continuous product innovations, reliability, and compliance with regulations.

A subsidiary of Carrier Company, Kidde, has retained its leadership in the industry with an extensive range of products, including ionization, photoelectric, dual-sensor alarms, and smart interconnected systems. Owned by Resideo Technologies, First Alert incorporates user-friendly details with long-lasting battery life into both standalone and intelligent alarms, thus cementing its dominance in the residential and small commercial segments.

Honeywell International Inc. remains an important player, especially in commercial-grade systems, providing smart fire detection solutions coupled with building automation. Nest Labs, a subsidiary of Google, has disrupted conventional models by linking smart alarms through the Google ecosystem, opting for a sleeker design and sophisticated features like voice alerts and app-based control. Siemens provides robust fire safety systems primarily designed for high-end industrial and commercial applications, where reliability and integration with the wider safety systems are critical factors.

The competitive scenario has become intense with emerging new entrants such as X-Sense Innovations and BRK Electronics adding to the technology developments. At the same time, companies like Universal Security Instruments and Ei Electronics continue to bank on low-cost models as well as regional advantages. The industry is seeing increasing investment into smart alarm technologies, integrating them into IoT platforms to make them interoperable for residential applications as well as institutional applications around the globe.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Kidde | 20-25% |

| First Alert | 18-22% |

| Honeywell International Inc. | 14-18% |

| Nest Labs, Inc. | 10-14% |

| Siemens AG | 8-12% |

| Other Key Players (Combined) | 14-18% |

| Company Name | Offerings & Activities |

|---|---|

| Kidde | It offers a wide range of smoke alarms, including smart as well as dual-sensor models with a strong OEM presence. |

| First Alert | Focuses on battery-operated, smart, and hardwired detectors with user-friendly interfaces. |

| Honeywell International Inc. | Specializes in commercial-grade fire detection systems with integrated automation solutions. |

| Nest Labs, Inc. | Smart alarms with voice alerts, mobile integration, and seamless Google ecosystem compatibility. |

| Siemens AG | Offers high-end, networked systems for industrial and commercial facilities. |

Key Company Insights

Kidde (20-25%)

It has a leading brand with a strong product line and worldwide distribution. Its innovations in wireless connectivity and dual-sensor technology keep it at the forefront of both the residential and commercial industries.

First Alert (18-22%)

Maintains strong brand loyalty with affordable, plug-and-play detectors and smart devices under the Resideo umbrella and addresses primarily the home industry.

Honeywell International Inc. (14-18%)

Pivots around institutional and commercial segments, including smoke alarms with broader building management and fire protection systems.

Nest Labs, Inc. (10-14%)

Disruptive presence by virtue of smart features, sleek design, as well as integration with the Google smart home platform, which is attractive to tech-inclined consumers.

Siemens AG (8-12%)

Fortress in high-end commercial fire safety systems with advanced, integrated smoke detection technologies.

The industry is slated to reach USD 2.2 billion in 2025.

The industry is predicted to reach a size of USD 4.6 billion by 2035.

Key companies include Kidde, First Alert, Honeywell International Inc., Nest Labs, Inc., Siemens AG, Johnson Controls International plc, BRK Electronics, X-Sense Innovations Co., Ltd., Universal Security Instruments, Inc., and Ei Electronics Ltd.

China, slated to grow at 9.1% CAGR during the forecast period, is poised for fastest growth.

Photoelectric smoke alarms are being widely used.

By type, the industry is segmented into ionization, photoelectric, and beam smoke alarms.

By application, the industry includes commercial, residential, and other applications.

By region, the industry covers North America, Latin America, Europe, Asia Pacific, and MEA (Middle East and Africa).

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.