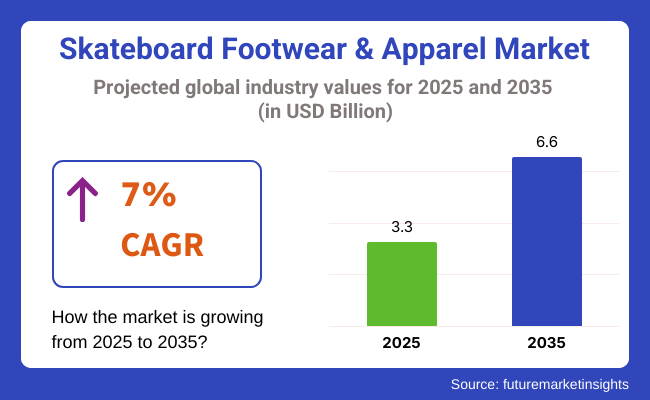

The global skateboard footwear & apparel market is poised for a significant upswing in the coming decade, fueled by the surging popularity of skateboarding as both a sport and a lifestyle. Worth around USD 3.3 billion in 2025, the industry is expected to reach about USD 6.6 billion by 2035, growing at a healthy CAGR of 7% over the forecast period.

This is being spurred by the increasing mainstream popularity of skateboarding, especially among younger generations and city dwellers. The entry of the sport into larger international competitions like the Olympics has contributed further to its visibility and popularity, opening up new paths for apparel and merchandise sales. Furthermore, cultural relevance in fashion, music, and urban wear has made skateboarding one of the major lifestyle trends, resulting in high demand for specialist, performance-driven footwear and apparel made for skaters.

Existing brands as well as new brands are surfing on this wave through collaborative projects, limited editions, and green product lines, which appeal to the socially conscious consumer of today. The development of e-commerce, backed by planned influence and social media marketing, is also playing a key role in bringing industries for skateboard clothing across the globe, including from the emerging economies.

However, the industry is still being confronted with unstable raw material prices and intensifying competition from broader athleisure categories. However, overall, the prognosis is favorable, as product design innovation, better durability, and comfort are expected to continue to keep skateboard-specific products highly pertinent.

As skateboarding continues to grow up from being a subculture to a mainstream lifestyle, the industry is also set to ride the wave of this cultural wave-driven by authenticity, creativity, and strong association with youth and urban culture.

Explore FMI!

Book a free demo

Skateboard shoe and clothing industry entails different stakeholders who provide different considerations with different priorities. Manufacturers of shoes and clothing are most concerned about the quality, fashion appeal, creativity, and durability of products, to provide fashionable yet functional products that capture the seriousness of skateboarding.

Merchants are interested in brand reputation, cost-effectiveness, and product demand, as this allows them to stock fashionable, popular items and remain profitable. Final consumers or, in this case, skaters are interested in durable, comfortable, and quality products that add to their performance and style.

The growing popularity of skateboard culture and fashion additionally drives product development, particularly design and technology such as greater support or sustainability material. With rapidly increasing popularity for skateboarding across the globe, the industry is witnessing increased consumer demand for performance-driven as well as lifestyle-driven skateboard footwear & apparel.

For manufacturers and retailers, being up to date on trends and offering comfort and quality remains the formula for enticing serious and casual skaters alike.

Between the years 2020 and 2024, the industry experienced considerable growth from the mainstream adoption of skateboarding as an activity or sport and lifestyle. Such culture rooted itself deep into life within cities; as a result of this, companies have responded by creating products that would cater to performance, streetwear, and fashion.

More so, with a social network as a facilitator, brands and influencers have taken to marketing skateboard fashion and footwear on sites, thus opening visibility and attractiveness to a wider and larger industry. A major factor that drove innovation in product development is aggressive spending to create long-lasting performance-enabling and comfortable skateboarding shoes and wear.

Looking into the future curve, skate footwear and wear are on the way to continued growth between 2025 and 2035. Sustainability will be enhanced even further in the future as companies manufacture environmentally friendly products using recycled materials and sustainable production practices. Besides, the developing industries will make the increased demand for skateboarding possible, together with the visibility brought by big sports events such as the Olympics.

Technology will also see the birth of ever-more-specialized products, such as shoes that promise better grip and durability for professional use. Celebrity influencer marketing and street culture will fuel demand still further, while customization will fulfill individualists and enable customers to customize their equipment.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Mainstreaming skateboarding, social media, and product innovation | Sustainability, tech, and globalization of skate culture |

| Performance, durability, comfort, and streetwear appeal | Sustainable products, innovative tech in shoes, customized and tailored designs |

| Skaters, streetwear, young adults | Wider consumer base from teenagers, urban white-collar workers, overseas industrie s |

| Improved performance with innovative products, online campaigns | State-of-the-art material, eco-friendly production processes, technology-enabled foot and garment characteristics |

| Early focus on strength and beauty | Extremely high focus on green material and environmentally friendly production processes |

| Sustained growth in the USA and Europe, particularly in urban centers | Growth in emerging economies, sustained leadership in the USA and Europe, particularly in urban centers |

| Celebrity endorsements and social media usage heavily drove sales | Sustained power of celebrity endorsements and social media personalities on popularity |

The industry is set to continue to grow steadily, driven by the growing popularity of skateboarding as a sport and way of life. As skateboarding culture becomes more mainstream fashion, demand for specialist clothing and footwear continues to rise. Nevertheless, there are a number of threats that may impact the growth and profitability of the industry in the next few years.

Among the major threats is the economic sensitivity of the industry. Skateboard clothing and shoes are discretionary buys, and in times of recession or economic downturn, people would reduce on spending on non-essential items. This would cause sales to shift in either direction, particularly for premium brands and products. The industry will suffer from revenue loss if people move towards essential goods instead of lifestyle items such as skateboard fashion and shoes.

A significant threat is supply chain disruption. Skate clothing and shoe firms are backed up by an advanced world supply chain in raw material procurement and production. Natural disasters, geopolitical tensions, or worldwide pandemics are occurrences that can stop production and delivery and bring about delays, shortages, or increased costs. The interruptions can cascade into an excess of fad merchandise and raise prices, possibly reducing consumer demand.

Industry competition and saturation are some other major threats to the skateboard apparel and footwear industry. The industry is highly competitive, with old and established brands and new entrants trying to capture customers' attention. So fierce is the competition that it might lead to industry saturation, and it becomes challenging for companies to differentiate and maintain profit margins. In addition, the presence of counterfeit products in the industry depletes brand value and consumer confidence, which, in turn, adds to competition.

Changing consumer tastes are another threat. With consumers increasingly going green and ethical, demand for green and ethically manufactured products is increasing. The companies that fail to innovate and keep up with these changes will lose consumer interest. If companies don't keep up with customers' expectations regarding green materials or transparent manufacturing processes, they will become outdated in the industry.

The environmental and trade policy concerns can affect the industry. With emphasis on environmental policy and stricter regulations surrounding materials and manufacturing processes, businesses in the skateboard footwear & apparel industry might need to invest more in compliance. The adjustment to these rules will be a cost of capital and can tighten profit margins, particularly for small producers.

To properly deal with these risks, skateboard apparel and footwear companies must diversify their supply bases, engage in research and development to create new and sustainable products, and gain strong brand differentiation. Responsiveness to changing customer trends and adherence to new legislation will also be key to long-term success in this dynamic and competitive industry.

In 2025, skate shoes were expected to lead in the skateboard footwear & apparel market, representing around 33.5% of the total industry share. T-shirts and tops are ranked next at a considerable 25%, emphasizing the deep cultural and performance associations both product types have with the skateboarding communities.

Because of their two-prong appeal, performance and style, skate shoes continue to lead the pack in this industry. Vans, with its old-school and Sk8-Hi classics, still reigns over the skate parks as well as the urban fashion scene. On the other hand, Nike SB's Dunk series, bolstered by limited-edition drops, collaborations with pro skaters and artists, and hype-driven streetwear crossovers, remains in the limelight.

DC Shoes and Emerica aim straight at core skateboarders with technical attributes such as vulcanized soles, padded collars, and impact-resistant footbeds engineered for tricks and rugged terrain.

The other half of these T-shirts and tops hold some 25% and thus corresponds to a massive cultural expression of skateboarding and its influence on youth apparel trends. Flame-logo tees by Thrasher Magazine remain the most easily recognizable in and outside skate culture as signals of real subcultural affiliation. Supreme, from skate roots, has developed widespread appeal through its graphics-intensive drops and strategic partnerships with brands such as The North Face and Louis Vuitton, creating a blurred line between skateboard and luxury fashion.

Other apparel brands, such as HUF and Santa Cruz, offer tops with a skating influence for both skaters and fashionistas. Their graphic tees change with the seasons and often have retro and psychedelic designs that resonate with the rebellious ethos of skateboarding.

The interplay of skate fashion into mainstream fashion, led by influencers, pro skaters, and social media, has encouraged brands to produce small capsules and exclusive collections marketed through online and skate specialty stores. These programs, in tandem with global recognition from events like the Olympics, are broadening the consumer appeal of both technical footwear and casual apparel and, in doing so, are strengthening their positions in the industry.

In 2025, the industry will mainly be driven by male consumer segments, as it is expected to account for 41% of the industry, followed by unisex segments that are expected to account for 24% of the industry.

The industry for men is well-positioned on account of the male-skewed culture of skateboarding, particularly in North America, Europe, and Australia. For example, Vans, DC Shoes, and Nike SB (Nike Skateboarding) have historically built associations with male skaters by offering durable shoes and functional streetwear in addition to limited collaborations with professional skateboarders. These brands continue to prosper due to their gender-specific product design, influencer-led marketing, and exclusive sponsorship of male athletes and events within skateboarding.

Unisex products, which comprise only 24% of the industry, are, however, a trend that is expected to grow and become more inclusive in the future. The move toward gender-neutral design is motivated by Gen Z and millennial consumers who prefer androgynous styles with flexible sizing.

For example, Adidas Skateboarding and Converse have started creating unisex collections that blend with ideal concepts of the past concerning gender. Such a move represents a strong value in urban industries and among new entrants into the skate culture, where personal identity is fluid and inclusive.

Holliday, the appeal of fashion-forward-comfort brands and innovative artists (e.g., Vans x Opening Ceremony, Nike SB x Supreme) to the general public, skate parks and streetwear scenes would further attract focus on unisex skate apparel and shoes. The emergence of baggy pants, oversized hoodies, and gender-neutral silhouettes will bring unisex segments into a sound area of strategic growth, particularly in Asia-Pacific and Latin America.

Increased investment by brands into segment-specific R&D, athlete endorsements, and digital retail avenues targeting traditional male audiences, as well as the growing customer base relying on unisex products, is also part of the plan as diversification continues and the industry expands.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

| UK | 4.9% |

| France | 4.5% |

| Germany | 4.3% |

| Italy | 4.1% |

| South Korea | 5.2% |

| Japan | 4.6% |

| China | 6.3% |

| Australia-NZ | % |

USA is expected to witness growth at 5.6% CAGR during the research period. Growing skateboarding culture and an entirely established streetwear fashion system further propel growth both in footwear and apparel segments. The continued popularity of skateboarding as both a sport and a lifestyle trend are a major driver of the demand as even more brands adopt skateboarding inspirations in collections of high-street fashion.

In addition to this, popular culture, including artists, influencers, and pro skaters, has widened consumer engagement with skateboarding merchandise. Urban-scale infrastructures and the wide accessibility of skate parks increase product exposure and utilization.

In addition, the expansion of online marketplaces, combined with brand collaborations and limited-edition drops, fuels consumer demand and creates brand love. Emphasis on sustainable and high-performance materials also aligns with changing consumer preferences, which fuel innovation in the industry. A positive youth demographic and the renewed Gen Z focus on 1990s fashion are further indicators of high industry potential through 2035.

The UKindustry will grow at 4.9% CAGR throughout the study. Skateboarding has become popular not only as a sport but also as an urban culture, especially in cities like London, Manchester, and Bristol. The growth of skateboarding events and Olympic-level participation has increased industry exposure and social acceptance of the sport, which otherwise was niche.

The fashion-forward youth industry in the UK is particularly attuned to worldwide skateboard fashion footwear and clothing trends. This demand is also further supported by the dominant role that streetwear currently plays in the current fashion.

Skate premium brands continue to grow through the means of selective ranges, quality branding, and collaborative efforts with artists and designers in the UK Specialty skate shops and websites are vital to product distribution, and they have made broad availability accessible to global and domestic brands. Further, ongoing urban development efforts typically include public spaces that are friendly to skate, which facilitates a healthy customer base for skateboard footwear & apparel.

The French industry will expand at a 4.5% CAGR during the study period. Skateboarding has been consistently adopted by youth culture, spurred by an affection for expressive fashion and artistic countercultures. Paris and Lyon in France are among the cities that have an active skate culture spurred by government-funded skate parks and events hosted by local communities. A synergy of fashion-conscious consumers and an active, creative community is prime terrain for skateboard apparel and footwear line expansion.

French fashion brands and individual labels have begun incorporating skateboarding aesthetics into their inspirations, blurring the line between luxury and street fashion. Product categories formerly deemed niche are now attracting more mainstream consumer attention.

Moreover, tourism-based retail in Paris and other cultural centers offers international consumers exposure. E-commerce penetration in France is comparatively high, enabling brands to target tech-aware youth groups effectively. French street culture and sustainability-focused brands are most likely to perform better over the coming decade, particularly as environmental concerns are on the increase among younger generations.

The German industry will post a growth of 4.3% CAGR during the research period. Urbanization and government investment in active lifestyles have created favorable environments for activities related to skating. Large cities like Berlin, Hamburg, and Frankfurt offer vibrant youth subcultures that are open to alternative fashion movements and sporting lifestyles. This creates an environment for sustained demand for long-lasting, functional, and stylish skateboard clothing and footwear.

The German consumer industry is quality-driven, with strong inclinations towards both performance and sustainability products. This is such that local and international brands with green materials and ethically produced processes are gaining a competitive advantage. Both physical outlets and growing e-commerce platforms offer total industry coverage.

Also, the geographical location of Germany in the EU makes logistics convenient and easy, allowing for brand proliferation within neighboring regions. The adoption of worldwide fashion trends, together with a pragmatic purchasing strategy, makes Germany a continuously increasing industry up to 2035.

Italy's industry is estimated to grow at 4.1% CAGR during the study period. Skateboarding in Italy has become more than a recreational phenomenon and is now strongly viewed as a representation of urban culture and individual identity. Cities such as Milan, Rome, and Bologna are experiencing an increase in skateboarding culture fueled by youth-led urbanization and skate-friendly amenities. Italian consumers are drawn to fashionable and visually appealing products that fit the fashion-focused trend of skateboard shoes and apparel.

The intersection of street fashion and high-end fashion-an area where Italy is especially abundant-is where domestic and international brands can introduce creative collections appealing to both fashion and functionality. Finally, boutique stores and online platforms provide convenient shopping channels for fashion-oriented consumers.

While the industry remains relatively small in size compared to others, a steady increase in cultural acceptance and integration in fashion fuels the growth potential during the forecast period.

The South Korean industry will grow at 5.2% CAGR during the study period. Skateboarding is very quickly gaining momentum among the young crowds, who consider it to be not only a sport but also a statement of fashion. South Korean metropolitan cities such as Seoul are slowly developing dynamic young subcultures that feed off international street trends and sporting apparel.

In a super-digitized fashion culture, South Korea facilitates the ease of brands quickly rolling out fresh collections and fueling sales by leveraging influencers and social commerce. Early industry absorption of international fashion trends is yet another dimension of its attraction, offering a fertile ground for board-inspired apparel and footwear.

Domestic designer foreign skateboard label collaborations are increasing, enhancing cultural context. The state investment in youth recreation and cutting-edge skateparks also improves infrastructure to facilitate sport. This blend of fashion, technology, and youth culture drives the optimistic projection for the South Korean skateboard wear and footwear industry to 2035.

The Japanese industry is expected to grow at 4.6% CAGR during the study period. A deep love for skateboarding and fashion innovation makes Japan a major force behind global skateboard fashion and footwear trends. Tokyo, Osaka, and Yokohama are major urban centers where skateboarding culture converges with fashion-conscious consumerism.

Japanese consumers have a high appreciation for exclusivity, craftsmanship, and design, which makes it simple for them to relate to limited releases and brand collaborations characteristic of the skateboard culture. The presence of well-known local brands and growing imports has created a multicultural, competitive retail industry.

Moreover, the blending of skateboarding in public spaces and cultural events has increased its visibility and appeal. Retailing strategies emphasizing storytelling, heritage, and authenticity are effective in this industry. These drivers underlie sustained long-term expansion and make Japan a fashion and innovation-driven segment of the industry.

The Chinese industry is projected to expand at a CAGR of 6.3% during the study period. Urbanization and increased exposure to global cultural phenomena have fueled the high level of interest in skateboarding. Government initiatives for urban sport and fitness and Olympic coverage for skateboarding have promoted mainstream acceptance and young participation.

China's vast consumer base, particularly in cities like Beijing, Shanghai, and Shenzhen, manifests increased demand for foreign brands and skateboarding apparel. China's retail digital backbone is one of the most developed in the globe, supporting scalable and rapid dissemination of product ranges. Brand awareness is increasingly built by local influencers and localized advertising campaigns.

Furthermore, partnership with local manufacturers offers efficiency and customization benefits. The burgeoning middle class, coupled with increased spending on lifestyle and fashion, will continue to propel skateboard apparel and footwear growth over the forecast period.

The Australia-New Zealand region will increase at a 5% CAGR during the study period. There exists a high outdoor culture and growing youth participation in action sports that form the foundation for a successful skateboard apparel and footwear industry.

Sydney, Melbourne, and Auckland are some of the cities that contain diverse and passionate skateboarding subcultures that often participate in casual as well as competitive activities. Australian and New Zealand consumers are very sensitive to sustainable, fashion-led products. The industry also enjoys a comparative per capita income and rising interest in online purchases, and accordingly, premium skateboard companies are readily accessible.

Additionally, efforts of native designers in cooperation with multinational entities have helped offer products that are appropriate for native consumption. Governmental support for parklands, programs, and the growth of mass media coverage in skateboarding activities further contribute towards cultural momentum. The region has been projected to sustain growth throughout 2035, considering the consistent rate of consumer lifestyle transformation and strong youth engagement.

The industry is an industry still growing with the speed of subculture influence, developing from streetwear and lifestyle branding. The main divisions among the interconnected fabric categories are feet and wearing apparel, which are distinctively competitive drivers.

On skateboard footwear giants such as VF Corporation (through Vans) and Nike Inc dominate with very renowned silhouettes and extensive retail distribution, having both being athlete supportive, active in the component of community incorporation and developed line in trends. Besides, Adidas AG and Sole Technology Inc. (Etnies, Emerica) are also insistent on novelties improvement and authenticity, particularly in core skate circles.

Streetwear native brands like Volcom and HUF Worldwide drive this apparel industry, which is deeply rooted in skate culture. Other powers in the variation-influenced premium niche include Primitive Skateboarding and Stüssy through collaboration. This continues to benefit from fashion crossovers and high brand affinity among youth consumers.

Market Share Analysis by Company (Skateboard Footwear)

| Company Name | Market Share (%) |

|---|---|

| VF Corporation | 20-24% |

| Nike Inc. | 16-20% |

| Adidas AG | 10-14% |

| Sole Technology Inc. | 8-12% |

| Other Players | 30-36% |

| Company Name | Market Share (%) |

|---|---|

| Volcom , LLC | 18-22% |

| HUF Worldwide | 14-18% |

| Primitive Skateboarding | 10-14% |

| Stüssy | 8-12% |

| Other Players | 34-40% |

| Company Name | Offerings & Activities |

|---|---|

| VF Corporation (Vans) | Ongoing skate team sponsorships and eco-friendly footwear lines with a global retail presence. |

| Nike Inc. | SB line innovation, limited edition drops, and integration of Nike tech for performance skateboarding. |

| Volcom , LLC | Launching skate-infused fashion capsules and sponsoring global skate competitions. |

| HUF Worldwide | Collaborations with pro skaters and streetwear icons; strong digital presence and lifestyle branding. |

Key Company Insights

VF Corporation (20-24%) (Skateboard Footwear)

Leaders in the footwear category via Vans are still a cultural favorite among skaters and streetwear fans alike.

Nike Inc. (16-20%) (Skateboard Footwear)

Blends performance engineering with street fashion, retaining strong demand for its SB (Skateboarding) line.

Volcom, LLC (18-22%) (Skateboard Apparel)

A heritage skater in action sports apparel with strong ties to action sports and continued innovation in design and fit.

HUF Worldwide (14-18%) (Skateboard Apparel)

Street culture-conscious brand utilizing brand partnerships and skateboard core authenticity to connect with international youth.

The industry is slated to reach USD 3.3 billion in 2025.

The industry is predicted to reach a size of USD 6.6 billion by 2035.

Key companies include Volcom, LLC, Element, NHS Inc., High Speed Productions Inc., CCS, Tactics, HUF Worldwide, Diamond Supply Co., Primitive Skateboarding, and Stüssy.

China, slated to grow at 6.3% CAGR during the forecast period, is poised for the fastest growth.

Skate shoes are being widely used, driving the majority of the industry’s growth.

By product type, the industry is segmented into skate shoes (slipon skate shoes, old skool & authentic shoes, others), t-shirt & tops (t-shirts, tank tops, jerseys inspired by skateboarding and skate culture), hoodies & sweatshirts, and bottoms (pants & sweatpants, shorts).

By consumer orientation, theindustry includes men, women, unisex, and kids.

By distribution channel, the industry is divided into direct sales/exclusive stores, specialty stores (skating), sports merchandise, departmental stores, online retailers (direct to consumers, third-party to consumers), and other sales channels.

By region, the industry covers North America, Latin America, East Asia, South Asia, Europe, Middle East & Africa, and Oceania.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.