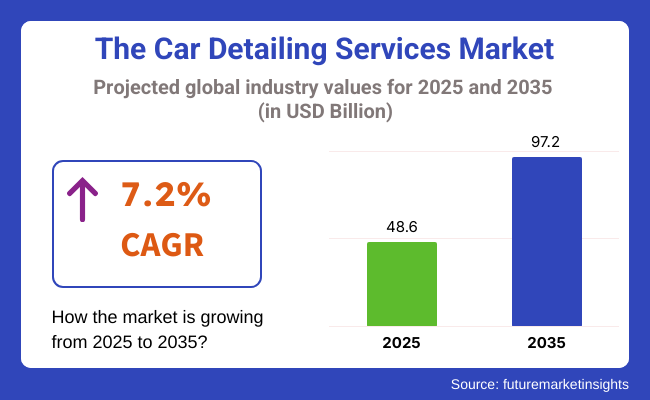

The car detailing services market size was USD 48.6 billion in 2025 and is projected to grow at a 7.2% CAGR throughout 2025 to 2035. The global vehicle detailing services market size is projected to grow to USD 97.2 billion by 2035. One of the key drivers of this growth is the increasing consumer demand for the longevity of vehicles, visual upkeep, and the increased popularity of high-end car care services.

As global car ownership continues to grow and there is a preoccupation with preserving car resale value, detailing services are becoming a more typical part of automobile maintenance. Urbanization and rising disposable income have led to a high demand for specialized exterior and interior car detailing services.

The services are now more considered necessities than luxuries, especially in dense urban zones where exposure to the environment deteriorates car appearance faster. Additionally, consumer preference goes for waterless and eco-friendly detailing processes, which propel the adoption of green solutions in service delivery.

There is a huge shift towards on-demand and mobile services, supported by digital booking platforms and customer-centric apps. This trend of convenience, coupled with improvements in the speed and quality of service delivery, is drawing in a wider consumer base. Commercial fleets, ridesharing vehicles, and car rental services are now large client segments due to their frequent need for routine, high-quality cleaning and maintenance.

Technology like ceramic coating, paint protection film (PPF), and ozone treatment have increased the technical sophistication of detailing. These added-value services are new sources of revenue for operators and greater vehicle protection, resulting in traffic from customers seeking long-term advantages.

Chains and franchises also continue to establish their presence by creating standardized service levels and loyalty programs, capturing a good share.During the forecast period, union of personalization, green behavior, and high-touch service models will remain at the center of transformation. Service companies that invest in advanced training, green technology, and user-friendly digital platforms will be well-positioned to take advantage of increasing customer expectations and repeat service demand.

Explore FMI!

Book a free demo

Although car detailing services seem far from the technical standards applied in industrial or healthcare monitoring, the intersection is in the increasing technological uptake and consumer demands across industries. In car detailing, growth in demand is directly related to changing consumer electronics in vehicles, e.g., infotainment systems, that need precision cleaning and maintenance. Consumers now demand services that treat delicate components with high precision.

Industrial monitoring impacts the professional-grade machinery applied in detailing-like high-pressure steamers and paint correction equipment-that require high performance and regulatory safety. In contrast, healthcare parallels are experienced in the disinfection standards implemented for interior sanitization, especially post-pandemic, focusing on safe and comprehensive cleaning practices.

Environmental issues are transforming product choice in detailing. Water savings, biodegradable products, and energy-efficient operations are being increasingly preferred, mirroring developments in ecological surveillance. Consumers in all segments are linking purchasing choices to wider values of sustainability, so regulatory conformity and green labels are becoming ever more significant factors in service distinction.

The automotive detail services industry is not exempt from exposure to risks. One of the fundamental risks is economic cyclicality; when times are poor, consumers scale down on discretionary expenditures, and automotive detailing is generally classified as a discretionary service. This macroeconomic sensitivity exposes revenue streams to being vulnerable during worldwide recessions or inflationary spurts.

The comparative simplicity of starting detailing operations, particularly mobile service operations, increases competition and encourages price cutting. In the absence of a unique value proposition or brand positioning, operators risk being unable to sustain profitability. Furthermore, ensuring consistent quality of service in numerous locations or franchise outlets continues to be an endemic operational issue.

The regulatory shifts, particularly relating to water consumption, chemical storage and handling, and waste disposal, can raise the costs of compliance. More stringent green laws in inner cities could restrain conventional detailing businesses, necessitating the expenditure on cleaner technologies. Lack of flexibility in transitioning fast to such measures could inhibit scaling and even disrupt business continuity in the case of small players.

During the period 2020 to 2024, the car detailing services market saw consistent growth due to rising consumer knowledge of vehicle care and appearance. The growth in disposable incomes and the increase in vehicle ownership accounted for the demand for professional detailing services.

Technological advancements led to the adoption of eco-friendly cleaning products and waterless washing. Additionally, mobile detailing services, which were convenient, also became popular, as customers could get their cars cleaned at places of their choice.

During the forecast period, radical changes are expected to happen. Integration of artificial intelligence and automation will probably make processes seamless, enhancing the efficiency of customer and service experience. Sustainability will continue to be a focus, with increased use of biodegradable products and water-saving technologies.

The expansion of electric vehicles (EVs) and autonomous vehicles may create new service demands, and the industry will have to adapt its offerings. In parallel, digitalization and subscription businesses will probably remodel customer engagement and service provision in the form of personalized and easily accessible options to consumers.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing motor vehicle ownership, rising disposable income, and elevated awareness of maintaining cars. | AI and automation integration, the spread of EVs, and demand for green services. |

| Use of eco-friendly cleaning agents and mobile service platforms. | Adoption of AI-based diagnostics, automated cleaning systems, and digital service platforms. |

| Classic one-time service packages and mobile detailing units. | Subscription models, on-demand services, and integration with digital platforms. |

| Emphasis on quality, convenience, and affordability. | Requirements for customized services, green practices, and frictionless digital experiences. |

| Compliance with local environmental and safety standards. | Compliance with global sustainability norms and adaptation to new automotive technologies. |

| Competition from local service providers and price sensitivity. | Need for sustained innovation, technology investment, and adaptation to changing consumer habits. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.9% |

| France | 5.7% |

| Germany | 6.0% |

| Italy | 5.5% |

| South Korea | 5.8% |

| Japan | 5.4% |

| China | 7.3% |

| Australia-NZ | 6.2% |

The USA is anticipated to grow at 6.8% CAGR over the study period. Strong car culture and increased consumer spending on automotive aesthetics are fueling demand for car detailing services. High vehicle ownership levels, especially of luxury and premium vehicles, underpin a long-term need for interior and exterior detailing. In addition, the emergence of mobile car detailing companies is transforming customer convenience, offering on-site services at workplaces and homes.

The growing interest in waterless and eco-friendly detailing products aligns with evolving environmental consciousness. Commercial fleets and ridesharing services also contribute significantly to service volumes, requiring regular upkeep to maintain vehicle condition and brand image.

In addition, expanding service packages that include ceramic coating, paint correction, and interior sanitization are enhancing customer retention. As the market is adopting digital platforms for bookings and tracking of services, car detailing is becoming a tech-enabled and customer-focused service industry with sustainable growth prospects.

The UK is likely to grow at 5.9% CAGR throughout the study. Increasing awareness of vehicle looks and upkeep among city-based consumers is fueling demand for professional detailing services. One can notice a trend toward green services that use biodegradable products and water-efficient methods that comply with national environmental regulations. Growth in mobile detailing units is also fueling growth, especially in heavily trafficked city locations where convenience holds supreme importance.

The UK's increasing electric vehicle (EV) industry is indirectly driving demand for EV-compatible and non-abrasive detailing services. Several consumers are turning to subscription-style detailing packages that guarantee routine maintenance, supporting a consistent and stable revenue flow for service providers.

Franchises and independent garages alike are also adding value-added services like engine bay cleaning, odor removal, and ceramic protection to drive differentiation. With an environmentally aware and technology-savvy customer base, the UK is moving towards high-quality, efficient, and green-oriented detailing solutions.

France is slated to grow by 5.7% CAGR over the analysis period. The growth of luxury and individual vehicle ownership among urban populations creates a positive business environment for detail services, and enhanced consumer interest in preserving vehicle resale value and external attractiveness is encouraging steady demand for professional car upkeep. Water conservation detailing trends are gaining pace, particularly across metropolitan regions, as environmental laws discourage conventional car washes.

Service diversification is becoming increasingly an essential element for competitiveness. Vehicle owners are increasingly demanding bundled services combining washing, polishing, waxing, and protective coats. More and more professionals and small businesses are turning to mobile units and app-based scheduling systems to deal with urban access and time constraints. The focus on sustainability and customer experience will continue to be at the forefront of the industry's evolution, fueling innovation in technique as well as in service delivery models.

Germany is forecast to expand at 6.0% CAGR over the study period. Renowned for its automotive superiority and engineering quality, Germany is a mature but consistently expanding region for car detailing solutions. High expectations of consumers regarding vehicle conditions, combined with a high affinity for luxury car brands, are driving demand for sophisticated detailing solutions. There is a growing interest in services like paint protection films, nano-coating, and high-gloss polishing.

Increased utilization of automated systems, particularly for dealership and fleet detailing, is making service delivery faster. Sustainable practices continue to be a high priority, driving the uptake of biodegradable and low-water products.

With the continued uptake of EVs among the German population, the service industry is creating detailing procedures to accommodate the specialty finishes and parts of electric vehicles. In addition, robust online service and booking management platforms are increasing consumer engagement and customer retention.

Italy will grow at a 5.5% CAGR over the study period. Italy's automobile aftermarket, based on craftsmanship and style, is experiencing a slow transition towards premium detailing services. Consumers are putting greater emphasis on car looks as a reflection of personal lifestyle, which is also driving demand for exterior treatments, polishing, and coating solutions upward. Tourism and short-term rental also generate scope for frequent detailing, particularly in urban areas where there are significant rental fleets. Car detail franchises and individual technicians are broadening service menus with interior steam cleaning, leather treatment, and odor elimination.

Eco-friendliness is also influencing consumer choice, with sustainable product usage being a make-or-break criterion for providers. Mobile detailing trucks with water reservoirs and generators are taking hold in residential and commercial areas. As personal cars become aesthetic and functional commodities, the demand for high-touch customized detailing services will rise throughout Italy.

South Korea will grow at 5.8% CAGR for the period studied. A culture of technology and a high-density urban infrastructure are driving demand for cutting-edge car detailing technologies. Pristine looks are important to South Korean buyers, and treatments such as ceramic coatings, smart film installation, and touchless wash are quickly becoming popular. The growth is driven by a robust base of digitally aware consumers willing to pay extra for digital appointment scheduling, open pricing, and loyalty schemes.

Electric and hybrid cars are driving service diversification, necessitating detailing techniques that can handle distinctive surface materials and electrical systems. Korean manufacturers are also increasingly collaborating with detailing service companies to provide post-sale maintenance packages, enhancing visibility in the industry. Sustainability is an up-and-coming trend, driving the use of environmentally friendly detailing products and water-conserving systems. With improving income levels and increasing car ownership, South Korea is set for steady growth.

Japan will grow at 5.4% CAGR through the course of the study. Japan's focus on precision and cleanliness is directly reflected in a highly developed demand for vehicle detailing. There are expectations of high-quality services and demand for detail-based over volume-based operations. Urban car owners are particularly attracted to mobile detailing and express packages promising convenience at the cost of compromising on quality.

As the automotive industry moves toward hybrid and electric vehicles, detailing operations are evolving to preserve and guard sensitive surfaces and advanced electronics. Technologies like anti-static treatments and UV protective coatings are becoming the norm in high-end packages.

In addition, Japan's aging population has fueled demand for valet services and pickup-drop-off convenience, especially among elderly car owners. Web platforms enabling flexible scheduling and payment are further simplifying access. The long-term stability of the market is supported by cultural norms that favor cleanliness, organization, and technological refinement.

China is poised to expand at 7.3% CAGR over the study period. Urbanization is at a fast rate, the middle class is growing strong, and rising disposable incomes are driving a healthy demand for motor care services. Vehicle protection and aesthetics are emerging as priorities across private owners as well as among fleet operators.

Chinese buyers are increasingly spending money on paint protective films, gloss finishes, and UV-blocking finishes to maintain car value and appeal. Digital platforms and mobile apps are taking a revolutionary path, with on-demand car detailing being tailored to busy urban lifestyles.

Several detailing startups have moved towards subscription-based models, combining frequent cleanings with protective services. Electric vehicle expansion is leading to the creation of specialized services that can be adapted for EV material and design.

In addition, increased environmental consciousness is fueling the need for biodegradable and waterless cleaning products. With the sustained expansion in individual car ownership and rising luxury aspirations, China will be the fastest-growing region providing car detailing in the following decade.

The Australia-New Zealand region will expand at a 6.2% CAGR throughout the study. The revenues are growing due to enhanced interest in the maintenance of vehicles as part of lifestyle and resale value plans. Detailing services are increasingly going mainstream within urban areas, with a bias toward mobile and at-home services that offer convenience and specialized care. Popular outdoor lifestyles within both nations also result in more wear and tear, thus encouraging frequent detailing.

There is a pervasive movement toward sustainability in environmental terms, with operators providing waterless washing, environmental chemicals, and low-waste operations. Luxury cars, motor homes (RVs), and commercial fleets are providing diversified industries for detailing technicians.

Growth in used car purchases and ridesharing is also stimulating steady demand for appearance preservation. As consumers pay more attention to the long-term care of their vehicles, detailing service providers are enlarging packages and offering new finishes to remain competitive.

The car detailing services are segmented into car exterior detailing, car wash and car wax. Car wash is estimated to take a market share of 38% due to the growing ownership of vehicles, urbanization, and customer demand for convenience. Operators such as Mister Car Wash, Zips Car Washand Quick Quack dominate this space with fast membership-based wash programs and elevated geographic presence in the USA

Car waxing services, at about 12% share, are increasing due to increased demand for paint protection, especially from mid- to high-end car owners. Engine detailing and exterior polishing belong to the "Others" category in this space. Interior detailing makes up a lower percentage but offers consistent growth opportunities, particularly with high-end car owners.

Vacuum conditioning controls the interior sub-segment with approximately 14% revenue share in 2025, utilized broadly in maintenance packages. DetailXPerts, Spiffy and other mobile detailing companies usually include this service as an option in their packages.

Leather conditioning, although niche at around 6% share, is growing in luxury car segments like Germany and the UAE, where leather upholstery is more common. Dashboard polishing, interior steam cleaning, and odor removal treatments come under the "Others" category and are mostly positioned as optional add-ons during the time of service.

Traditional service stations have the largest portion of the share, which is approximately 65%. They include conventional detailing shops, franchise garages, and auto service centers offering bundled detailing services. Companies like AutoNation, Jiffy Lube, and Maaco have a competitive edge by taking advantage of loyalty programs and price volume and building brand loyalty.

These service stations are especially well-liked in rural and suburban areas where mobile service access is low. Furthermore, alliances with rental firms and car dealerships further solidify their subscription revenue streams. The physical infrastructure of these stations supports multi-car service capacity, which remains a fundamental aspect of fleet contracts.

On-demand service, though smaller at approximately 35% share, is expanding rapidly, particularly in the cities and amongst younger, technology-savvy consumers. Spiffy, MobileWash, and Washé are a few of the firms revolutionizing the market with mobile app book-in, live tracking, and sustainability through water-saving technologies.

This segment is especially strong within the metropolitan zones of North America, the Middle East, and Southeast Asia. Due to standardization challenges in quality of service and scalability, innovations like subscription plans and contactless payment will lead to a robust CAGR of 8-10% over the forecast period.

The car detailing services market in the United States and worldwide remains moderately fragmented; the global market consists of multinational companies, regional detailing chains, and luxury boutique service providers. Leading players such as 3M Company, Splash Car Wash, Autobell Car Wash, Inc., Elite Detailing & Protection, and Delta Sonic have been using technological integration, brand credibility, and customer loyalty programs as competitive tools against each other.

While traditionally associated with the automotive business, 3M Company is actively involved in the detailing market through branded service offerings in collaboration with certified detailers using its materials, which include ceramic coatings, films, and polishes.

Splash Car Wash invested heavily in New York City and the northeastern USA, stressing service speed and reliability, somewhat bundled with membership programs. Autobell Car Wash, Inc. operates a hybrid model that combines automated wash tunnels and hand-finished detailing for those customers looking for speed combined with an eye for detail.

Elite Detailing & Protection thrives in the high-end detailing space for ceramic coating and paint protection film (PPF) services and concierge services for owners of luxury cars. At the same time, Delta Sonic finds strength in offering hybrid fuel, wash, and detail services that could benefit from the synergies of service locations and competitive pricing.

Smaller but noteworthy competitors of AutoKorrect and M-PIRE Auto Detailing are also concentrating on mobile detailing and superior car care. HERRENFAHRT is offering luxury car care services across Europe, thus intensifying competition in the global niche industry. Eco-friendly innovations in detailing, subscription-based solutions, and mobile approach to service delivery are transforming the landscape of the sector.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| 3M Company | 16-20% |

| Splash Car Wash | 12-15% |

| Autobell Car Wash, Inc. | 10-13% |

| Elite Detailing & Protection | 8-11% |

| Delta Sonic | 7-10% |

| Other Key Players | 31-37% |

| Company Name | Offerings & Activities |

|---|---|

| 3M Company | Provides detailing products and ceramic coatings and partners with detailing centers globally. |

| Splash Car Wash | Operates full-service car wash and detailing outlets with a strong regional presence. |

| Autobell Car Wash, Inc. | Offers tunnel car washes with optional interior and detailing add-ons across USA states. |

| Elite Detailing & Protection | Specializes in high-end vehicle protection, ceramic coating, and PPF for luxury vehicles. |

| Delta Sonic | Integrates fuel, car wash, and detailing services with membership packages. |

Key Company Insights

3M Company (16 to 20%)

It holds a leading position due to its global distribution of detailing materials and strategic service partnerships.

Splash Car Wash (12-15%)

A fast-growing regional leader with scalable detailing operations and multi-service bundling strategies.

Autobell Car Wash, Inc. (10-13%)

Maintains customer loyalty through consistent service quality and accessible hybrid wash-detailing models.

Elite Detailing & Protection (8-11%)

It focuses on the premium segment and offers highly customized protection solutions for exotic and luxury cars.

Delta Sonic (7-10%)

Competes with integrated fuel, wash, and detail services across Midwest and Northeast USA locations.

Other Key Players

The industry is slated to reach USD 48.6 billion in 2025.

The industry is predicted to reach a size of USD 97.2 billion by 2035.

Key companies include 3M Company, Splash Car Wash, Autobell Car Wash, Inc., AutoKorrect, Elite Detailing & Protection, M-PIRE Auto Detailing, Oasis Car Detailing, Delta Sonic, HERRENFAHRT, and Action Car Detailing.

China, slated to grow at 7.3% CAGR during the forecast period, is poised for the fastest growth.

Car exterior detailing services are being widely used.

The car detailing services market is segmented into exterior detailing, interior detailing, complete detailing, engine detailing, and ceramic coating.

The industry encompasses services for cars, SUVs, trucks, motorcycles, and boats.

Service channels include stand-alone detailing businesses, car dealerships, gas stations, and mobile detailing services.

The market is categorized based on location into urban areas, suburban areas, and rural areas.

Geographically, the market is divided into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.