The global cold plunge tub market was USD 0.87 billion in 2025 and is forecasted to grow at a CAGR of 8.3% during 2025 to 2035. The valuation will be USD 1.92 billion in 2035. One of the driving factors is rising consumer interest in wellness, recovery, and health therapy at home, particularly by fitness enthusiasts and athletes for purposes of muscle recovery and circulatory.

There is an increasing product availability and design innovation, such as temperature-controlled smart tubs, filtration systems, and app-driven automation. The demand is growing in residential, commercial fitness studios and luxury wellness resorts as cold plunge therapy becomes mainstream. Buyers are increasingly investing in cold therapy equipment due to its alignment with improved mental health, reduced inflammation, and improved immune systems.

Technological innovation is revolutionizing product function and appeal. Companies are adopting modular and low-power consumption designs that are easy to install, energy-efficient, and responsive to indoor or outdoor settings. Such technologies are expanding the industry to city users and small or custom system hunters.

Another top trend driving expansion is the social media promotion of cold therapy protocols. Elite athletes and health influencers have helped popularize, leading to broader adoption by non-elite consumers. The cultural shift toward biohacking and performance enhancement also supports ongoing demand expansion.

North America is the leader in consumption and innovation, but the Asia-Pacific region is also a rapidly emerging high-growth frontier with increasing wellness infrastructure and disposable income. Strategic partnerships between fitness chains, hotels, and wellness centers will most likely be instrumental in cold plunge tub adoption over the forecast period.

Explore FMI!

Book a free demo

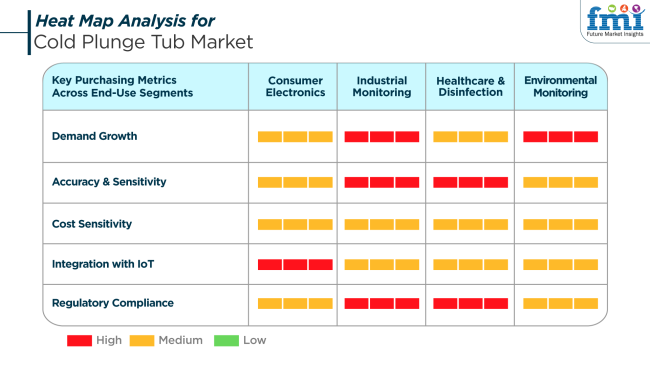

Cold plunge baths are seeing growing adoption throughout consumer electronics in the form of smart integrations like app-based temperature control and usage monitoring. These capabilities match the trend toward health-oriented smart home systems. Demand is strong in this category based on lifestyle-driven preferences and wellness personalization.

In medical and disinfection applications, these tubs are being used for therapy-based recovery and immune system strengthening. Medical-grade tubs require better accuracy, high-precision temperature control, and robust regulation compliance, especially in rehabilitation and physiotherapy environments. Integration is modest but is likely to grow as healthcare centers embrace connected wellness solutions.

Environmental observation and industrial application are also changing. In this case, cold therapy tubs find application in specialized occupational therapy settings and are utilized in harsh or outdoor environments where heavy-duty design is needed. Cost and regulatory issues are high priorities, particularly in energy consumption and water management that are regulated. In every segment, buying decisions are based on technology integration, performance, and documented health benefits.

The industry is subject to inherent risks associated with consumer education and adoption barriers. Demand is increasing, but most potential users are not aware of the scientifically proven advantages of cold therapy, leading to a slower rate of conversion from awareness to purchase. Misconceptions about the safety and effectiveness of cold water immersion could prevent mass acceptance. Steep initial capital outlays, particularly for commercial or high-end versions, could restrain penetration by mid-tier customers.

Furthermore, operational issues concerning electricity usage, water usage, and maintenance might discourage adoption in areas with high energy regulation standards or low infrastructure. Volatile raw material prices and supply chain sensitivities heighten these economic risks.

Regulatory and compliance issues can also affect growth momentum. In hospitals and hospitality facilities, certification and compliance with sanitation standards are non-negotiable. Producers have to adapt continuously to changing compliance standards, which can elevate operational complexity and overhead. Absent constant innovation and brand credibility, businesses may not be able to maintain a competitive edge in this expanding but fragile market.

Between 2020 and 2024, the global industry developed steadily due to increasing awareness of the health advantages of cold-water immersion, such as reduced inflammation, improved circulation, and enhanced recovery for athletes. There were innovations in tub designs, such as temperature control, portability, and simplicity. Commercial establishments, including spas, wellness centers, and fitness clubs, were the initial ones to embrace it, followed by growing needs from in-home residential customers who sought wellness solutions from their own homes.

During the forecast period 2025 to 2035,technological innovations will introduce the development of smart cold plunge baths with app support, real-time temperature adjustment, and self-cleaning filter systems. Sustainability would be the highest priority on everyone's list, with businesses investing in green technology and environmentally friendly materials. Moreover, the incorporation of these tubs into overall wellness ecosystems, such as cryotherapy and infrared saunas, will be the driving factor, and they will be a staple of modern health and recovery protocols.

Comparative Market Shift Analysis: Cold Plunge Tub Market 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: More focus on core cold plunge tubs with hand-cranked temperature control. | Technological Integration: Smart cold plunge baths with connectivity through a smartphone app and automation options. |

| Consumer Demographics: Primarily marketed to sports enthusiasts and wellness enthusiasts. | Extended Demographics: A broader market with fitness-conscious consumers and spas that retail wellness. |

| Key Drivers: Worldwide adoption of cold water immersion as a well-being health enhancer. | Technological Advancements: Integration of intelligent features and power-saving technologies. |

| Sustainability Efforts: Initial steps towards green materials and effective energy designs. | Sustainable Technologies: Development of eco-friendly materials and effective energy technology. |

| Distribution Channels: Enlargement of e-commerce platforms for greater availability. | Integrated Wellness Solutions: Integration of cold plunge tubs in integrated wellness systems. |

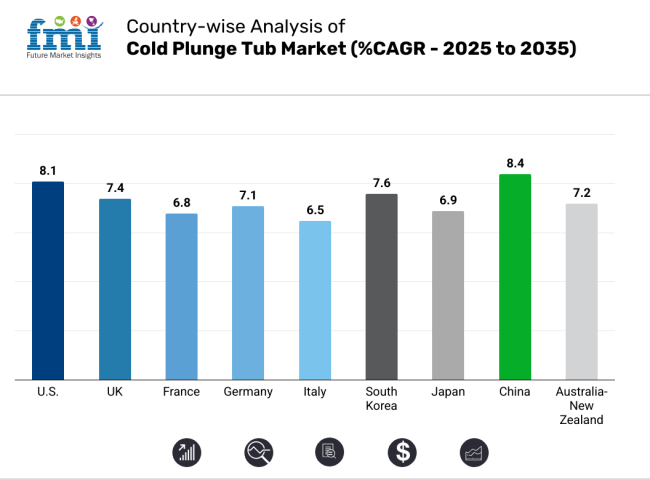

The USA will grow at 8.1% CAGR throughout the study period. The industry is headed for gradual growth with the rise in consumer demand for wellness and recovery treatments. More athletes, fitness enthusiasts, and health-oriented consumers are incorporating cold therapy into their regimens. With the advent of home wellness setups and high-end spas, demand for premium, technologically advanced tubs is increasing.

There is support from strong consumer expenditures and a very willing audience for new wellness technology. Further, product innovation, such as digital controls and small, energy-efficient units, is improving appeal. Institutional customers like sports clubs, health clubs, and fitness centers are also playing an important role in driving demand.

The trend toward customized health and wellness experiences is driving investment in home recovery solutions, such as plunge tubs. In addition, growing knowledge of the value of cold exposure therapy-like decreased inflammation, enhanced circulation, and improved muscle recovery-is driving sales. As companies spend more on influencer-driven campaigns and online marketing, the popularity and appeal of cold therapy tubs in the USA are likely to grow considerably during the forecast period.

The UK will register a growth rate of 7.4% CAGR throughout the study period. The Cold Plunge Tub Market is gaining traction with rising health consciousness and changing fitness culture.

The increased popularity of wellness trends, including biohacking and cold water therapy, is triggering consumers to investigate cold plunge solutions. British consumers prefer home-based wellness investments, especially in urban areas where wellness spaces and home spas are being incorporated into modern lifestyles. Furthermore, the increasing popularity of Nordic wellness regimens, such as saunas and ice baths, is driving demand in both residential and commercial segments.

Professional sports clubs, physiotherapy clinics, and high-end fitness boutiques are becoming leading adopters of cold plunge technology. The UK is also experiencing an increase in wellness retreats and spas that are integrating advanced plunge systems into luxury therapy packages. Seasonal temperature changes and cultural openness to holistic health approaches support a favorable environment for cold water immersion practices.

France is expected to grow at 6.8% CAGR during the study period. The industry is slowly growing as consumer lifestyles grow more wellness-driven. A boost in fitness and mental health awareness is prompting consumers to look for holistic wellness routines that incorporate hot and cold therapy.

The salesare picking up pace in cities and resort areas, where cold therapy tubs are being added to high-end spa packages. The impact of conventional European hydrotherapy, which is commonly used in thermal spa areas of France, is also increasing the popularity of cold water immersion therapy. Home adoption is limited but is expected to increase as customers crave health-enhancing home installations. The main push factors are the increasing popularity of homemade wellness spaces and the lure of digital detox regimens with the support of physical regeneration.

Commodity demand is higher, especially within hotels, well-being resorts, and physiotherapy clinics. With the growing acceptability of cold therapy by wider audiences via new media and physical fitness bloggers, knowledge about physiological and psychological improvements will be enhanced.

Germany is anticipated to witness growth at a 7.1% CAGR throughout the study period. The industry is steadily developing, owing to the nation's long-time respect for wellness treatments. Being well-known for possessing a healthy-oriented populace and rampant application of hydrotherapy, Germany offers a productive environment for adopting cold plunge technology. The growing importance of physical recovery and athletic performance is motivating sports organizations, health clubs, and wellness clinics to invest in cold therapy equipment.

German consumers are also turning toward in-home wellness systems, specifically those that provide functionality, energy efficiency, and clean design. Germany's cold climate and cultural acceptance of wellness rituals like saunas and contrast bathing create a favorable environment for growth. Demand is being further assisted by insurance-initiated wellness initiatives that promote recovery therapies, making public exposure to cold plunge therapies more widespread.

Commercial installations at medical and rehab facilities are gaining traction, propelling the validity of cold therapy as a substantiated and workable treatment option. The marketplace will be stimulated by high-quality products, environmentally friendly initiatives, and engineering expertise during the forecast period.

Italy will grow at 6.5% CAGR over the study period. There is moderate growth, influenced by the increasing popularity of holistic well-being and lifestyle-based health habits. Italy has been historically focused on beauty and relaxation but is now seeing a move towards therapeutic and functional wellness products.

Growing awareness of the health benefits of cold exposure therapy is driving adoption among spas, resorts, and rehabilitation facilities. Major cities like Milan and Rome are most active, with increasing demand for wellness-oriented residential and commercial properties.

Residential installations of cold plunge tubs remain relatively modest but are anticipated to expand as wellness trends become more mainstream. Italy enjoys a high spa culture, and the tourism industry focuses more on health and wellness packages. A lack of consumer education and a desire for conventional wellness measures has restrained adoption to some extent. Government initiatives to promote mental and physical well-being in the post-pandemic period and growing awareness through influencer campaigns and niche marketing by premium wellness brands are likely to boost adoption.

South Korea will grow by 7.6% CAGR over the forecast period. The demand is increasing due to the high-end wellness experiences and self-care regimens. South Korea quickly adopted biohacking and recovery-oriented therapies. Influencer culture and wellness-focused media are speeding up public fascination with cold water immersion.

The growth in upscale fitness clubs and spa chains is giving way to a fertile ground for commercial uptake, especially in metropolitan areas like Seoul and Busan. Growing overlap between technology and wellness is also fueling product innovation in intelligent plunge systems that provide real-time feedback and customizable settings.

South Korean consumers prefer minimalist, space-saving designs that can fit harmoniously into contemporary interiors. In-home adoption is increasing, particularly across younger generations looking for wellness investments that resonate with aspirational lifestyles. Increased disposable income and government aid to health and wellness infrastructure also contribute to a supportable growth environment.

Japan is projected to expand by 6.9% CAGR over the study period. The Cold Plunge Tub Industry is growing steadily, fueled by the nation's rich heritage of hydrotherapy and wellness. Consumers in Japan are becoming increasingly open to contemporary cold therapy practices, which are highly compatible with established onsen culture and opposite bath customs. The tubs’ use is most widespread in wellness spas and rehabilitation facilities, where the therapeutic value is being maximized for physical as well as mental health.

Commercial demand is robust, especially in urban areas like Tokyo and Osaka, where high-end spas and sports clubs are incorporating plunge tubs into recovery services. Residential adoption is still limited by space, but small and energy-efficient versions are attracting interest. The industry is being driven by growing awareness of cold exposure as a way to reduce inflammation, improve circulation, and increase mental clarity. As wellness becomes a central theme in consumer behavior post-pandemic, cold plunge tubs are expected to become increasingly popular, aided by a society that appreciates health, balance, and simplicity.

China is anticipated to expand at 8.4% CAGR over the study period. The industry is set to experience high growth, fueled by increasing income levels, urbanization, and an expanding wellness economy. Consumer interest is moving towards recovery-focused wellness solutions, with cold therapy becoming increasingly popular among fitness enthusiasts and high-end urban consumers.

Cold plunge tubs are being increasingly launched in high-end gyms, boutique wellness centers, and luxury spas, particularly in cities such as Shanghai, Beijing, and Shenzhen. China's tech-savvy consumers and demand for smart home integration are driving innovation in digitally enabled plunge systems. Younger age groups are highly interested in biohacking and contemporary wellness lifestyles.

Commercial investment in upscale wellness infrastructure is heightening visibility and stimulating demand. Government efforts towards improving public health and wellness education are likely to further boost growth. With China's population size and increasing demand for high-end health experiences, the nation is well placed to become a world leader in cold plunge adoption by the end of the forecast period.

The Australia-New Zealand region will grow at 7.2% CAGR over the study period. Growth is driven by rising wellness awareness and a robust fitness culture. In Australia, demand for recovery modalities like ice baths and cold-water immersion is widening among both residential and commercial segments.

Wellness retreats, sports training facilities, and high-end spas are among the drivers of expansion. New Zealand's keen affiliation with the natural world and wellness practices that connect with it serve to underpin adoption even among rural residents, as well as urbanites. Homebuyers are moving in on amenities with wellness-increasing benefits, such as the use of cold plunge tubs as a catalyst for mental sharpness, healing, and physiological fortitude.

Fitness-minded constituents across both nations are adopting contrast therapy, ranging from saunas and cold dips, as forms of everyday recovery modalities. The industry is also being driven by tourism initiatives promoting wellness as part of regional travel experiences. A supportive regulatory environment, combined with a climate conducive to outdoor cold therapy use, further enhances the outlook through 2035.

In 2025, the industrial sector will dominate with a 78.5% revenue share, while the residential sector will account for 21.5%.

A large share of revenue comes from commercial uses due to the increasing trend of wellness and recovery therapies in professional settings. Cold plunge tubs are being more widely used in luxurious spas, gyms, wellness centers, and professional sports training facilities. These facilities use the tubs for therapeutic effects, including promoting circulation, reducing muscle inflammation, and helping in faster recovery post-exercise.

CryoCure and Renu Therapy are leading proactive wellness brands that offer up-to-the-minute cold plunge systems targeting commercial clients, with such features as temperature control, high-quality filtration systems, and easy-to-use interfaces. Sports teams and fitness centers are increasingly implementing cold plunge tubs in their post-exercise recovery routines, enhancing the adoption. For example, an ice barrel could be considered the most carried out and important among commercial ones due to its space-friendliness and ease of maintenance.

As investment by homeowners in wellness solutions progresses, so does the residential sector. Awareness about the numerous advantages cold therapy has on one's physical and mental health has precipitated an ever-increasing, unyielding surge of interest in cold plunge tubs for at-home uses, especially among health-conscious individuals.

Plunge and Medi Crystal are some of the companies that cater to this segment with compact, user-friendly tubs designed for home installs. The demand for residential cold plunge tubs comes from consumers who want a spa-type experience at home, together with those who aim to upgrade their personal recovery regimes.

In 2025, above-ground cold plunge tubs are expected to lead with a share of 60.1% of the overall share, while in-ground tubs are projected to have a share of 39.9%.

The above-ground cold Plunge Tubs are highly valued products because of their adaptable use, easy installation, and economical pricing. Such products have quite high demand in both residential and commercial applications since they offer very quick installation without major construction or landscaping needs. Above-ground models are more popular due to portability and access.

Generally, they are placed in private home spas, gyms, and evergreen outdoor wellness resorts. Leading players like Plunge and Ice Barrel sell their models of above-ground tubs, providing less maintenance, adjustable temperature, and suitably durable materials against varied environmental conditions. On the other hand, the low initial investment as compared to in-ground types of fuels further interest owing to the paradigm shift toward home wellness.

As for the in-ground Cold Plunge Tubs, they make their aesthetic statement in high-end luxury locations and are generally regarded as permanent fixtures. Mostly commercially present in wellness centers, luxury spas, and high-end residences. Always provide that seamless look of a custom-designed pool or spa area.

Maintenance is rather costly and would need professionals for installation; hence, in-ground cold plunge tubs are the most dreamt-of due to their permanency and the value they have for upscale properties. Blue Haven Pools & Spas are among the brands that offer in-ground solutions that integrate into larger custom outdoor retreats. Great appeal is made to luxury homeowners and commercial clients looking for a high-end experience.

Cold plunge tubs have drawn in wellness enthusiasts, athletes, and health-seekers looking for alternative treatments, such as cold-water immersion, to promote recovery and overall well-being. The industry has grown significantly, with companies introducing innovative solutions ranging from portable to luxury tubs, which are both residential and commercial-friendly.

Major companies are reaching out to consumers looking for high performance and convenience in the cold plunge. With more individuals giving priority to physical health, there has been increased demand for high-quality, durable, and affordable products.

North America is the most dominant region. It has been triggered by some convergence of wellness trends and an increasing number of fitness centers incorporating cold plunge therapy into their routines. These companies are concentrating on improving their product offerings by incorporating features like sophisticated temperature control systems, filters for clean water and ergonomic designs to increase the comfort level of users. As more options become available across various price levels, competition is on the rise.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Hot barrel | 15-18% |

| The Ice Bath Co. | 12-15% |

| Ice Barrel | 10-13% |

| Cold Tub | 8-10% |

| iCool | 7-9% |

| Other Players | 30-35% |

Key Company Insights

Hotbarrel dominates the industry with a projected 15-18% share, providing high-quality, long-lasting products for home and commercial applications. With its cutting-edge features, Hotbarrel has established itself as a leading option for consumers looking for high-performance cold therapy tubs with temperature adjustment and ergonomic functionality.

The Ice Bath Co. ranks second, with a share of 12-15%, dedicated to portable, easy-to-use tubs. Its small and handy designs appeal to home consumers and to the sports and fitness sectors as an affordable yet impactful cold plunge option. Ice Barrel commands a revenue share of about 10-13%, with its practical, minimalist design and extremely high popularity among home wellness consumers. Its emphasis on quality and simplicity has earned it one of the highest brands in the home-use cold plunge.

Cold Tub commands an 8-10% share with reconfigurable plunge tubs for residential and business applications. It is famous for its top-of-the-line, durable equipment with filtration and temperature control options; Cold Tub has set a strong presence in the competition.

iCool enjoys a 7-9% share with tubs that are budget-friendly with emphasis on ease of use and portability, ready to be availed by a mass consumer base. Renu Therapy, Plunge, Brass Monkey Health Ltd, Jacuzzi Inc., and BuiltHQ also contribute to the revenue with a range of products that suit luxury and budget segments, increasing the variety of the industry.

The industry is slated to reach USD 0.87 billion in 2025.

The industry is predicted to reach a size of USD 1.92 billion by 2035.

Key companies include Hotbarrel, The Ice Bath Co., Ice Barrel, Cold Tub, iCool, Renu Therapy, Plunge, Brass Monkey Health Ltd, Jacuzzi Inc., BuiltHQ, BlueCube Wellness, Polar Monkeys, NordicWave, Arctic Spas, Diamond Spas, SWISS Wellness Inc., QCA Spas, Jazzi Pool and Spa Products Co., Ltd., Guangzhou Monalisa Bath Ware Co., Ltd., and HONGYUE PLASTIC GROUP.

China, slated to grow at 8.4% CAGR during the forecast period, is poised for the fastest growth.

The industrial sector is being widely used.

The segmentation is into Commercial and Residential applications.

The segmentation is into In-ground and Above-ground Cold Plunge Tubs.

The segmentation is into North America, Europe, Asia Pacific, the Middle East and Africa, and South America.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.