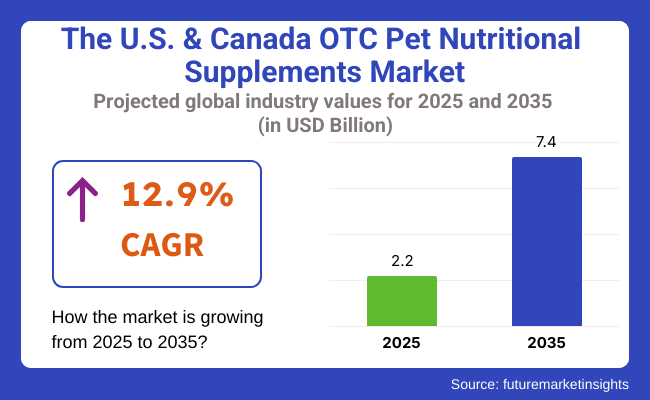

The USA & Canada OTC Pet Nutritional Supplements Market size was USD 2.2 billion in 2025 and is projected to grow at a 12.9% CAGR from 2025 to 2035. The market is projected to reach USD 7.4 billion by 2035. This high growth is primarily due to the pet humanization trend and owners growing preference for preventative health, as seen in trends in the human wellness space.

As pets are increasingly regarded as family members, pet owners are increasingly turning to nutritional supplements to aid immunity, joint health, digestion, bone health, and general age-related issues. Post-pandemic, this trend has accelerated as pet adoption increased and preventive care of pets became more popular. Demand is particularly strong for joint-support supplements, calm aids, and probiotics for dogs and cats.

Product innovation leads the charge in driving sales expansion. Brands are introducing advanced formulations with natural ingredients, functional superfoods, and vet-validated claims. Soft chews, powders, and flavorful liquids have become highly popular, being easier to administer and raising compliance in animals. Tailored supplement protocols by breed, age, or health profile are also gaining traction among digitally savvy pet owners.

Distribution is also being reshaped by online shopping and omnichannel merchandising strategies. Online channels offer access to product ratings, auto-replenishment subscriptions, and personalized recommendations in addition to convenience and loyalty. Pet specialty retailers and veterinary clinics continue to drive growth through professional recommendation and wellness program bundles, while big-box retailers are increasing mass-market access.

Globally, the USA is in the lead by virtue of its developed pet care infrastructure and high per-capita pet spending. However, the Canadian market is recording rapid expansion driven by increased pet ownership, regulatory changes supporting natural pet products, and increased retail penetration. The two nations are promoting regulatory channels that uphold efficacy claims along with safety guidelines, further supporting OTC products.

Explore FMI!

Book a free demo

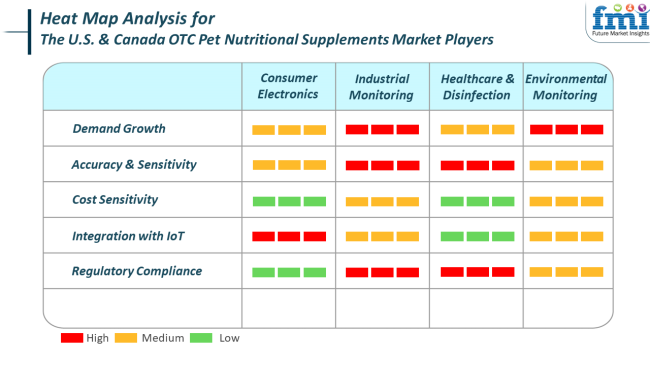

In the OTC pet nutritional supplements market, the closest fit is with the healthcare and wellness market, where transparency, safety, and efficacy influence buying behaviors. Purchasers demand the same quality level and functional delivery in pet supplements as they desire for human products, with dosage accuracy and responsiveness to pet health requirements being non-negotiable.

Demand grows across urban and suburban homes fueled by an older pet population, preventive veterinary medicine, and wellness trend alignment of lifestyle. The leading products addressing anxiety, joint support, and immune system health are at the forefront. Palatability, ingredient transparency, and packaging sustainability are now deciding factors.

Cost sensitivity is moderate, and there is an increasing desire to spend money on high-quality, clinically substantiated formulations. Compliance with regulations particularly health claims and ingredient safety-under greater scrutiny from consumers as well as regulators. Companies focusing on vet validation and GMP compliance are likely to gain long-term consumer confidence.

Even with solid momentum, the OTC pet nutritional supplement market is confronted with a succession of strategic threats. At the top of this list is regulatory uncertainty. Although the category is self-regulated, uneven enforcement and loose guidelines regarding therapeutic claims can create saturation with poor or untested products.

Quality control is a further urgent issue. With increasing demand, small and private-label producers might have difficulty consistently sourcing ingredients, ensuring dosage accuracy, and controlling contaminants. One safety issue or product recall can have broad reputational implications, as pet owners regard supplements as health staples.

Intense competition and brand fragmentation risk long-term differentiation. With increasing new entrants and wellness crossovers from human supplement companies, businesses have to invest in research, online engagement, and product innovation in order to be differentiated. Partnerships with vets, technology-powered personalization, and open labeling will be pivotal in managing such competitive and operating risks.

The United States and Canada OTC pet nutritional supplements market experienced substantial growth from 2020 to 2024, driven primarily by the increased awareness of pet health, the humanization of pets, and greater consumer spending on pet wellness.

The growing concern for the health and well-being of pets in the long term, particularly with respect to digestive, joint, and coat health, resulted in a huge uptick in the adoption of nutritional supplements. In addition, there was a strong movement towards natural and organic pet supplements due to pet owners becoming more health-conscious and wary of using artificial ingredients. The development of online marketplace platforms and e-commerce facilitated the availability of these products, with most pet owners turning to digital channels for supplement purchases.

From 2025 to 2035, the OTC pet nutritional supplement market will continue to expand based on the ongoing need for natural and tailor-made nutritional products. Formulation advances, such as omega-3 fatty acids and probiotics, will be at the forefront.

Targeted supplements driven by AI-backed recommendations and based on the specific health profile of each pet will become more mainstream. Sustainability will also gain increased attention, with consumers demanding environmentally friendly packaging and ingredients.

Regulatory policies will become stricter, with greater transparency and safety in the labeling and sourcing of ingredients. Increased health-aware millennials and Gen Z pet owners will propel the demand for premium, functional, and scientifically proven nutritional supplements for pets.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Healthy growth by way of awareness for health, pet humanization, and rising expenditure. | Sustained growth, with emphasis on personalized and natural supplements. |

| Platforms increased, making the products more available. | Personalization through AI and personalized nutrition plans for pets. |

| Demand for natural, organic, and health-oriented supplements. | Move towards premium, sustainable, and environmentally friendly products. |

| Increase in products for digestive, joint, and general pet health. | Advancements in probiotic, omega-3, and condition-specific formulations. |

| Launch of more stringent regulations for labeling and ingredient safety. | Stronger regulatory control and emphasis on transparency of ingredients. |

| Growing pet health consciousness and humanization of pets. | Need for customized, functional, and evidence-based nutritional supplements. |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| Canada | 5.8% |

The United States OTC pet nutritional supplement market is registering strong growth from the rising phenomenon of pet humanization and improving attention to preventive animal healthcare. Pet owners are increasingly embracing animals' wellness regimes that reflect the health trends for humans, such as the intake of vitamins, probiotics, and joint supplement health.

The increased number of companion animals, particularly dogs and cats, combined with improving disposable incomes and pet health awareness, is driving demand for over-the-counter nutritional products. Retail growth in both online and offline channels is also enhancing product visibility and accessibility.

Innovation is another driving factor, with companies launching specially designed supplements suited for various life stages, breeds, and medical conditions like anxiety, mobility, skin, and digestion.

The availability of natural and organic formulations appeals especially to health-conscious consumers. Moreover, increased veterinarian, pet influencer, and social media campaign influence is driving consumer preference and accelerating product adoption.

Clarity in regulation regarding ingredient safety and label integrity also promotes consumer confidence. With robust distribution infrastructure, increasing pet adoption levels, and a culture that is increasingly treating pets as family, the USA will continue to show steady growth in all major product categories.

The Canadian OTC pet nutritional supplements market is gaining momentum as pet ownership continues to grow and consumer knowledge of animal health becomes more mainstream.

Canadian pet owners are increasingly focusing on holistic health, with increased interest in dietary supplements that promote immune function, joint health, mental performance, and overall well-being.

With the rising cost of veterinary care, many consumers are looking to preventive strategies, such as the use of supplements, to enhance the quality of life and prevent more severe health measures. There is an escalating demand for natural, local, and clean-label products.

Producers are meeting this with targeted products, such as supplements for older pets, active pet breeds, and pets with certain dietary sensitivities. Retail through pet specialty stores, pharmacies, and internet-based retailers is growing, complemented by the convenience and education provided through online platforms.

The availability of domestic and international brands provides a competitive environment that fosters innovation and price accessibility. In addition, increased interaction among veterinarians and supplement companies is helping fuel evidence-based product recommendations. With a stable regulatory environment and robust consumer confidence in domestic production standards, Canada is poised to drive steady growth in the OTC pet nutritional supplements segment during the forecast period.

The joint support category is expected to own 24.6% of the United States & Canada OTC Pet Nutritional Supplements Market in 2025, while multivitamins are expected to comprise 20.5%. Growing emphasis on preventive health and the general wellness of pets makes these two types of products dominant in the industry.

Joint support generally has enhanced product sales, especially in the case of dogs, owing to various forms of joint problem conditions with aging or breed predispositions. Glucosamine, chondroitin, and MSM supplements are recommended for enhancing mobility and reducing inflammation. Nutra max Laboratories is a prominent player with joint support products under Cosequin.

Joint support supplements are the favorites of most veterinarians for joint health maintenance and arthritis treatment because they really work. Increasing weight has caused concern over joint health in pets, especially in large breeds, thus contributing significantly to the category's giant revenue share.

Multivitamins have a good revenue share as awareness among pet parents regarding balanced diets has increased. Multivitamins can fill the gaps of an unbalanced diet and contribute to the body's systems, such as immune function, skin health, and digestion.

Pet Honesty, Zesty Paws, and VetIQ manufacture multivitamin-based products targeting unique concerns; for example, Pet Honesty's 10-in-1 Multivitamin Soft Chews contain vitamins, minerals, and antioxidants necessary for overall health and vitality. This product is popular among pet owners seeking a well-rounded nutritional boost for their pets.

The demand for joint support and multivitamin supplements will witness uninterrupted growth with the growing focus on preventive healthcare, along with increased pet ownership and humanization. These products, along with the projection of a proactive style in pet care, aid in ensuring that the pet is at its best health and wellness throughout life.

In 2025, within the United States & Canada OTC Pet Nutritional Supplements Market, chews and treats are expected to lead with an estimated revenue share of 35.2%, followed closely by tablets and capsules at 34.0%. The popularity of these two forms is largely driven by ease of administration, palatability, and the convenience they offer to both pet owners and pets.

Pet owners prefer chews and treats, particularly for dogs, because these products are perceived as tasty, rewarding, and easy to use. These supplements are frequently designed to be palatable so essential nutrients can be administered into the mouth of a pet without any force required.

For instance, chewable supplements like multivitamins and joint support from companies such as Zesty Paws and VetIQ have become very popular among pet owners. The Zesty Paws Product Core Vitality Soft Chews is a mixture of nutrients important to both immune and joint health. It is, therefore, highly sought-after due to ease of administration and the enjoyment felt by the pets as they receive it as a treat.

Compared to chews, tablets and capsules are lesser preferred forms; however, due to high accuracy in dosing and long shelf life, they still command a significant share in the industry. Preferring these forms could sometimes be due to strict supplement regimens or very high doses.

An instance of a product that falls under these categories is Nutramax Laboratories' Cosequin tablets designed for joint health. They are popular for pet owners to give to their pets to ensure continuous and efficient treatment of any joint-related condition. Such a product would cater to the needs of pet owners who place importance on precision with a supplement and prefer that it be measured in a controlled dosing tablet or capsule.

The United States and Canada OTC Pet Nutritional Supplements Market is operated by a blend of veterinary pharmaceutical conglomerates, specialized supplement brands and holistic wellness companies that cater to the exponentially growing demand among pet owners in matters concerning health and preventive care.

Key players who constantly innovate, differentiate their products, and develop and implement omnichannel distribution strategies are Elanco Animal Health Inc., Zoetis Inc., Nutramax Laboratories, Pet Honesty and Zesty Paws.

Elanco Animal Health Inc. develops scientifically validated pet wellness supplements using its vast veterinary knowledge. Oftentimes, these supplements are seen to bridge Rx and OTC channels. Likewise, Zoetis Inc. is adding to its pet supplement range, developing evidence-based formulations aimed at joint health, immune support, and skin care, often with recommendations by veterinary clinics. These companies have excellent access to veterinarians and are well-established in retail and e-commerce.

Nutramax Laboratories holds the top place among glucosamine and chondroitin brands with its long-standing Cosequin, along with an array of other condition-focused supplements. Pet Honesty sets itself apart with its natural, USA-made formulations, which have enjoyed rapid growth DTC and on Amazon, particularly in functional chew formats. Zesty Paws, now part of H&H Group, has created its niche around the use of premium ingredients such as probiotics and omega oils combined with palatability and target benefits for dogs and cats.

Mid-tier players such as Natur Vet and Vetri Science are looking to increase shelf space in mass retail, while newer brands such as Pet Naturals of Vermont and Ark Naturals are emphasizing clean-label trends. Strategic acquisitions sustain this fierce competition, as well as co-branding strategies with veterinary clinics and product innovations.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Elanco Animal Health Inc. | 16-20% |

| Zoetis Inc. | 13-17% |

| Nutramax Laboratories | 12-15% |

| Pet Honesty | 10-13% |

| Zesty Paws | 8-11% |

| Other Key Players | 27-33% |

| Company Name | Offerings & Activities |

|---|---|

| Elanco Animal Health Inc. | Offers condition-specific supplements for joint, skin, and immune health; expanding OTC lines via vet partnerships. |

| Zoetis Inc. | Focused on science-backed formulations, increasing pet-targeted SKUs in large retail chains and online pharmacies. |

| Nutramax Laboratories | Known for flagship brands like Cosequin and Dasuquin, dominant in the joint health space. |

| Pet Honesty | Natural chewable supplements; strong e-commerce presence; recent expansions into functional blends. |

| Zesty Paws | Premium lifestyle supplement brand emphasizing palatability, probiotics, and omega-rich blends. |

Key Company Insights

Elanco Animal Health Inc. (16-20%)

A leader in both Rx and OTC pet wellness, it expands with clinically validated nutritional products targeting senior and active pets.

Zoetis Inc. (13-17%)

Strengthens its wellness portfolio with vet-endorsed supplements; growing footprint through DTC and veterinary clinic partnerships.

Nutramax Laboratories (12-15%)

Maintains leadership in joint health through its trusted Cosequin brand, expanding into digestive and cognitive support.

Pet Honesty (10-13%)

Disruptive DTC player with a natural-first approach; focuses on grain-free, soft chew formats gaining rapid consumer adoption.

Zesty Paws (8-11%)

Premium supplement brand with strong digital marketing; well-positioned in multivitamin and calming aid segments.

The industry is slated to reach USD 2.2 billion in 2025.

The industry is predicted to reach a size of USD 7.4 billion by 2035.

Key companies include Elanco Animal Health Inc., Pet Honesty, Zoetis Inc., Nutramax Laboratories, Beaphar, Nestle Purina, Nutri-Vet, NaturVet, VetriScience Laboratories, Zesty Paws, Pet Naturals of Vermont, Grizzly Pet Products, and Ark Naturals.

The USA, slated to grow at 6.5% CAGR during the forecast period, is poised for the fastest growth.

Joint health and multivitamin supplements are being widely used.

The segmentation is into multivitamins, omega-3 fatty acids, probiotics, joint support, digestive enzymes, skin & coat support, and calming supplements.

The segmentation is into tablets & capsules, liquids, powders, chews & treats, and sprays.

The segmentation is into dogs and cats.

The segmentation is into modern trade, departmental stores, care service centers, online retail (direct to consumers and third party to consumers), support care centers, and pet specialty stores.

The regions covered are the United States and Canada.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.