The Anti-aging Vitamins Market is valued at USD 1.78 billion in 2025. As per FMI's analysis, the Anti-aging Vitamins Industry will grow at a CAGR of 8.8% and reach USD 4.01 billion by 2035.

In 2024, the industry witnessed a notable uptick in consumer demand, particularly driven by the growing middle-class population in emerging economies such as India, Brazil, and Indonesia. Increased health awareness post-COVID-19 contributed to a surge in online sales of anti-aging supplements, with e-commerce platforms witnessing double-digit growth in this category.

The industry also saw a shift toward personalized and plant-based formulations, as consumers sought clean-label and sustainable alternatives. Leading players like Herbalife, Amway, and Nature’s Bounty introduced new SKUs tailored to gender-specific and age-specific needs, contributing to higher consumer engagement. Regulatory clarity in key industries like the USA and the EU also helped streamline product launches and encouraged innovation.

In 2025 and beyond, the industry is expected to maintain momentum, with advancements in nutritional science enabling more targeted formulations. AI-driven personalization and DNA-based supplement recommendations will gain popularity. The aging global population and increased preventive health spending are expected to fuel steady growth. However, industry players will need to navigate challenges like rising raw material costs and increasing scrutiny over product claims.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.78 billion |

| Industry Value (2035F) | USD 4.01 billion |

| CAGR (2025 to 2035) | 8.8% |

The Anti-aging Vitamins Industry is expanding rapidly, driven by rising health awareness and demand for preventative wellness solutions. Consumers are increasingly seeking natural, science-based supplements to support healthy aging, pushing companies to innovate and personalize their offerings. Brands investing in research-backed, clean-label products stand to gain, while those relying on outdated formulations or lacking digital presence may fall behind.

Explore FMI!

Book a free demo

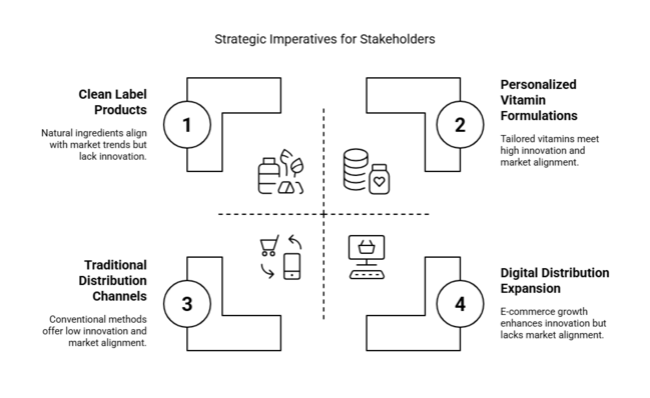

Invest in Product Innovation and Personalization

Executives should prioritize R&D to develop science-backed, personalized anti-aging vitamin formulations tailored to specific age groups, genders, and lifestyles.

Align with Clean Label and Wellness Trends

Stakeholders must ensure product transparency, using natural and plant-based ingredients to align with consumer preferences for clean-label, sustainable wellness solutions.

Strengthen Digital and DTC Distribution Channels

Expand e-commerce capabilities and form strategic partnerships with digital wellness platforms to boost direct-to-consumer (DTC) reach, while exploring acquisitions to enhance industry presence and distribution strength.

| Risk | Probability - Impact |

|---|---|

| 1. Regulatory changes affecting supplement classifications and claims | Medium - High |

| 2. Supply chain disruptions impacting raw material availability | High - Medium |

| 3. Consumer skepticism over product efficacy and safety | Medium - High |

| Priority | Immediate Action |

|---|---|

| Expand Personalized Product Lines | Conduct feasibility study on DNA-based and age-specific vitamin offerings |

| Strengthen Digital Sales Infrastructure | Initiate consumer feedback loop via e-commerce and health app integrations |

| Boost Brand Trust and Transparency | Launch clean-label certification and third-party testing disclosure program |

To stay ahead, companies must accelerate investment in personalized, science-driven anti-aging vitamin solutions while aligning with clean-label and digital wellness trends. This intelligence highlights a growing consumer shift toward proactive health management, signaling the need for deeper R&D into targeted formulations and enhanced direct-to-consumer strategies.

Brands should reassess their product portfolios, streamline regulatory compliance efforts, and strengthen digital and e-commerce capabilities to capture industry share. Building strategic partnerships with wellness platforms and investing in transparent labeling will be key to gaining consumer trust and long-term loyalty. This shift should immediately inform 2025 budgeting, innovation roadmaps, and go-to-industry plans.

| Countries | Regulatory Impact |

|---|---|

| USA | In the USA, the FDA regulates dietary supplements, including anti-aging vitamins, under the Dietary Supplement Health and Education Act (DSHEA). Manufacturers must follow Good Manufacturing Practices (GMP) for quality and consistency. These certifications are mandatory for marketing anti -aging vitamins. |

| UK | In the UK, the Food Standards Agency (FSA) ensures dietary supplements, including anti-aging vitamins, meet safety standards. The European Food Safety Authority (EFSA) reviews health claims to ensure they are scientifically supported. |

| France | In France, the ANSES ensures dietary supplements like anti-aging vitamins meet safety standards. France follows the EU’s Nutritional & Health Claims Regulation, ensuring that any claims made about anti-aging benefits are scientifically valid. |

| Germany | In Germany, the Federal Institute for Risk Assessment (BfR) monitors dietary supplements, including anti-aging vitamins. Germany follows the EU Health Claims Regulation, requiring health claims to b e scientifically substantiated. |

| Italy | In Italy, the Ministry of Health regulates dietary supplements to ensure they meet safety standards. Italy follows EU regulations on health and nutrition claims, requiring scientif ic proof for anti-aging claims. |

| South Korea | In South Korea, the Ministry of Food and Drug Safety (MFDS) regulates anti-aging vitamins to ensure they meet safety and efficacy standards. Manufacturers must also obtain GMP certificatio n to produce these supplements. |

| Japan | In Japan, the Health Promotion Act regulates dietary supplements like anti-aging vitamins. Products making health claims must comply with the FOSHU program, which requires approval to en sure their safety and efficacy. |

| China | In China, the National Health Commission ensures dietary supplements, including anti-aging vitamins, meet safety standards. Manufacturers need certification from the China National Food and Drug Administration (CFDA) to sell these products. |

| Australia-NZ | In Australia, the Therapeutic Goods Administration (TGA) regulates dietary supplements for safety and efficacy. In New Zealand, the Ministry for Primary Industries (MPI) ensures supplements meet safety standards and validate health claims. |

The skin care segment is projected to experience significant growth, driven by increasing consumer demand for anti-aging solutions targeting facial skin. With a projected CAGR of 9.5% from 2025 to 2035, this segment is the fastest-growing within the anti-aging vitamins industry.

Factors such as heightened awareness of skin health, the popularity of wellness products, and the efficacy of topical anti-aging treatments contribute to this growth. Consumers are increasingly seeking products that promote skin elasticity, reduce wrinkles, and improve overall skin appearance, leading to sustained demand in the skin care segment.

Niacinamide is anticipated to be the fastest-growing ingredient in the anti-aging vitamins industry. With a projected CAGR of 11.0% from 2025 to 2035, it stands as the highest-growing ingredient segment. Niacinamide's popularity is attributed to its multifunctional benefits, including improving skin elasticity, evening skin tone, and reducing fine lines. Its effectiveness in addressing multiple skin concerns makes it a preferred choice in anti-aging formulations, contributing to its rapid growth in the industry.

Online stores are expected to be the fastest-growing distribution channel for anti-aging vitamins. With a projected CAGR of 12.0% from 2025 to 2035, online retail is the highest-growing channel segment. The convenience of online shopping, coupled with the rise of direct-to-consumer (DTC) brands, contributes to the increasing preference for purchasing anti-aging vitamins through online platforms. Consumers value the ease of access, variety of products, and often competitive pricing offered by online stores, driving this segment's growth.

Serums are projected to experience the highest growth in the anti-aging vitamins industry, with a projected CAGR of 10.5% from 2025 to 2035. This makes it the fastest-growing product segment. The demand for serums is driven by their high efficacy in delivering concentrated active ingredients, which is crucial for consumers seeking quick and visible results.

Serums are also considered a premium product, with advanced formulations catering to more specific anti-aging concerns such as wrinkles, firmness, and skin rejuvenation. Their growing popularity among consumers, especially those with high disposable income, contributes to this significant growth trajectory.

Sales in the USA are anticipated to grow at a CAGR of 7.9% from 2025 to 2035. The USA industry continues to be lucrative due to strong consumer interest in wellness and preventative healthcare. High spending capacity, aging baby boomers, and a growing millennial base keen on early anti-aging care support this trend.

E-commerce penetration and the popularity of personalized supplements also contribute significantly. Innovation in delivery formats like gummies and capsules further enhances appeal. Regulatory clarity by the FDA supports new entrants, while increasing product visibility via influencers and digital campaigns keeps this mature industry steadily expanding.

Anti-aging vitamins industry in the UK are anticipated to grow at a CAGR of 7.0% from 2025 to 2035. The industry is driven by rising interest in healthy aging and the surge in self-care products among Gen Z and millennials. With a mature supplements industry, UK consumers prefer evidence-based, clean-label formulations, especially those with collagen, retinol, or niacinamide.

Post-Brexit regulatory updates and alignment with international certifications create both challenges and opportunities. Digital retail and awareness campaigns are boosting eCommerce traction. Despite economic fluctuations, demand for science-backed, anti-aging wellness products continues to support steady growth in this region.

Sales in France are anticipated to grow at a CAGR of 3.2% from 2025 to 2035. This is one of the slowest-growing industries due to its maturity and saturation in the beauty supplement category. While French consumers remain highly conscious about skincare and natural wellness, they favor topical treatments over ingestible supplements.

Regulatory oversight by ANSES is stringent, leading to longer product development cycles. However, clean and organic formulations do find favor. Brands that highlight safety, sustainability, and French pharmacological heritage continue to sustain demand. Despite slow growth, France remains a critical industry for premium, niche players.

In Germany sales are anticipated to grow at a CAGR of 6.8% from 2025 to 2035. Germany maintains a balanced mix of innovation and consumer trust in health supplements. The industry is regulated under EFSA guidelines, ensuring product safety and credibility. German consumers are well-informed and prefer clinically-backed ingredients like ascorbic acid and multivitamins.

Pharmacy chains and health stores dominate offline retail, while online platforms are gaining popularity. With a focus on science, sustainability, and product transparency, Germany continues to support new product launches, especially in the natural and vegan anti-aging vitamin space.

Anti-aging vitamins industry in Italy are anticipated to grow at a CAGR of 6.7% from 2025 to 2035. Italy’s industry thrives on traditional beauty ideals paired with increasing interest in nutraceuticals. Consumers here show preference for plant-based and Mediterranean diet-inspired formulations.

The popularity of collagen and multivitamin blends is notable, especially among women aged 30-50. Italy’s pharmacies, cosmetic boutiques, and herbal chains are the key distribution channels. EU compliance and local certification standards ensure quality, but product innovation is crucial to stand out. While the industry is not hyper-competitive, brand differentiation and storytelling can drive stronger engagement.

In South Korea sales are anticipated to grow at a CAGR of 6.6% from 2025 to 2035. Beauty innovation remains at the heart of this industry, but skincare still dominates over ingestible formats. However, growing awareness of “beauty-from-within” has led to a rise in demand for anti-aging vitamins. K-beauty brands have begun launching serums and capsules with advanced ingredients like niacinamide and retinol.

Consumers expect high functionality and aesthetic packaging. Strict KFDA regulations encourage formulation transparency. While still niche compared to skincare, the ingestible anti-aging segment is rapidly gaining momentum among younger, appearance-conscious demographics.

The industry in Japan is anticipated to grow at a CAGR of 8.9% from 2025 to 2035, the highest among all evaluated countries. With one of the world’s oldest populations, Japan represents a prime industry for anti-aging vitamins. The Japanese consumer is highly health-conscious, and the government actively promotes healthy longevity.

Functional foods and supplements are deeply integrated into daily routines. Key ingredients like collagen, vitamin C, and ceramides are widely accepted. Regulatory support for “Food with Functional Claims” (FFC) further accelerates innovation. Japan's demand is driven by a cultural emphasis on internal beauty and age-defying wellness.

Sales in China are anticipated to grow at a CAGR of 8.5% from 2025 to 2035. China remains one of the most lucrative industries, fueled by a booming middle class and increasing health awareness. The popularity of beauty supplements is rising, with a preference for traditional Chinese medicine-inspired blends and modern vitamins.

Cross-border eCommerce platforms like Tmall and JD.com are vital for foreign brands. Government support for domestic nutraceutical manufacturing and rising female workforce participation also contribute. China’s rapid urbanization and digital-first beauty culture make it a growth hotspot for both global and local players.

In Australia and New Zealand, the sector is anticipated to grow at a CAGR of 7.2% from 2025 to 2035. These countries benefit from a health-savvy population and a well-regulated supplements industry. Consumers trust brands with transparent labeling and organic ingredients.

Demand for anti-aging products like multivitamins and skin-nourishing capsules is growing, especially among women aged 35-55. The TGA and Medsafe maintain stringent quality control, enhancing product credibility. While the industry is not large, its high per-capita spending and inclination toward wellness create a favourable environment for steady growth. Online retail and influencer marketing continue to expand reach.

The anti-aging vitamins industry is moderately fragmented, with both established multinational corporations and emerging startups competing for industry share. Companies are focusing on strategies such as competitive pricing, product innovation, strategic partnerships, and industry expansion to gain a competitive edge.

Leading companies are investing in research and development to introduce innovative products that cater to consumer demand for effective anti-aging solutions. They are also forming strategic partnerships and pursuing mergers and acquisitions to expand their product portfolios and global presence. Additionally, companies are enhancing their digital marketing efforts to reach a broader audience and improve customer engagement.

In 2024, the anti-aging supplements market witnessed several strategic developments. Nestlé Health Science acquired a majority stake in Orgain, a plant-based nutrition company, to enhance its presence in the health and wellness segment. Herbalife Nutrition introduced a new line of anti-aging supplements featuring collagen and antioxidant-rich ingredients, catering to the rising consumer interest in skin health and longevity.

Toward the end of the year, the European Food Safety Authority (EFSA) approved new health claims for certain anti-aging compounds, encouraging companies to reformulate their offerings to include scientifically validated ingredients. Meanwhile, GNC Holdings expanded its online retail footprint in the Asia-Pacific region to tap into the growing demand for age-supportive nutritional products among a digitally engaged consumer base.

L’Oréal Paris leads the anti-aging vitamins industry with an estimated 7.6% share. The company’s strength lies in its diversified anti-aging product line containing vitamins C, E, and pro-retinol. Its science-backed formulations and continuous clinical testing reinforce customer trust. L’Oréal’s dominance in both topical skincare and nutricosmetics-particularly in Europe and Asia-has positioned it as a go-to brand for holistic aging solutions. Its investment in biotech innovation and direct-to-consumer sales platforms has bolstered its industry influence.

Unilever controls around 6.9% of the global industry, backed by brands like Dove and Nutrafol. The company has successfully entered the ingestible beauty space with vitamin-rich supplements targeting aging concerns like skin elasticity and hair thinning. Unilever’s robust distribution network and acquisition-driven expansion strategy-especially in the USA and APAC regions-help maintain its lead. Its focus on sustainable and clean-label products also aligns well with evolving consumer trends.

Procter & Gamble (P&G) holds a 4.9% industry share, thanks to brands like Olay and SK-II which integrate vitamin B3, C, and peptides. P&G’s advantage lies in wide accessibility and strong retail partnerships. With increasing investments in nutri-cosmetic crossovers and digital outreach, it maintains strong momentum in the USA, India, and China.

Beiersdorf Limited-parent to NIVEA-commands 4.2% of the industry. Its Q10 vitamin-enriched range targets aging skin affordably. Beiersdorf’s strong European base and penetration into Latin America and Southeast Asia support its continued growth. Investment in vitamin-enriched night serums and oral beauty supplements is underway.

Natura & Co. has around 3.8% industry share, strengthened by The Body Shop and Aesop brands. The company blends botanical extracts with anti-aging vitamins, gaining popularity among sustainability-conscious buyers. Its direct-selling model in Latin America and growing e-commerce base globally support expansion.

Avon Products, Inc. holds 3.5% share globally, relying on vitamin-rich serums and tablets within its Anew line. Avon leverages its vast network of beauty reps, particularly in Eastern Europe and Latin America, to push anti-aging solutions. The recent integration with Natura & Co. is enhancing supply chain efficiency and product innovation.

Coty Inc. commands around 3.2%, gaining traction through CoverGirl and Philosophy brands. Its anti-aging vitamin skincare is complemented by growing supplement launches. Coty’s shift toward clean beauty and focus on wellness-oriented branding is aiding its position in North America and Western Europe.

Revlon holds 2.9% share, with offerings that combine anti-aging skincare and dietary supplements. The brand focuses on affordability and wide availability. Its renewed focus on online distribution and mid-range vitamin-enriched lines is key to maintaining relevance.

Oriflame Cosmetics takes about 2.6% of the industry, driven by its Wellness by Oriflame segment which offers anti-aging multivitamins. Its direct selling model and presence in Eastern Europe and India fuel continued growth. Scientific claims and clean-label appeal resonate with a health-conscious audience.

Kao Corporation controls 2.3% of the global industry with its brands Bioré and Sofina integrating anti-aging vitamins in skincare. With strong Japanese roots and a growing Chinese footprint, Kao’s focus on UV protection and early-aging prevention vitamins offers strong regional appeal.

pmdbeauty.com & Age Sciences Inc. jointly account for 1.8%, focusing on high-performance anti-aging tools and supplement blends. Their tech-meets-beauty strategy appeals to younger consumers embracing skin longevity trends. While their presence is niche, rising demand for hybrid beauty wellness solutions positions them for rapid growth.

The anti-aging vitamins industry is valued at USD 1.78 billion in 2025.

The industry is projected to grow at a CAGR of 8.8% and reach USD 4.01 billion by 2035.

Growth was driven by rising health awareness, especially in emerging economies and post-COVID wellness trends.

Personalized, plant-based, and clean-label formulations are becoming increasingly popular in the industry.

Companies should invest in product innovation, sustainable ingredients, and digital distribution to stay competitive.

The industry is segmented into cream, serums, tablets/capsules, syrup and others

The industry is segmented into skin care and hair care

The industry is divided into retinol, niacinamide, ascorbic acid, multivitamin

The industry is divided into supermarkets/hypermarket, cosmetic stores, online stores, pharmacies and specialty stores

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania and Middle East and Africa (MEA)

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.