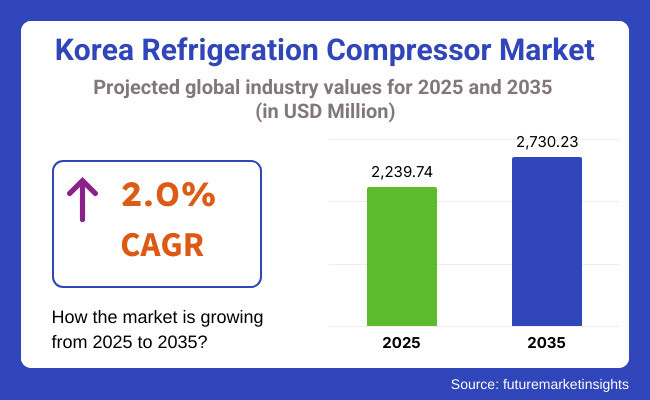

The Korean refrigeration compressor market is estimated to account for USD 2239.74 million in 2025. It is anticipated to grow at a CAGR of 2.0% during the assessment period and reach a value of USD 2730.23 million by 2035.

2024 Developments: The South Korean refrigeration compressor industry recorded an increase in revenue in 2024 at USD 2,195.8 million, up from USD 2,156.2 million in 2023. It was dominated by the following key drivers: Residential and Commercial Air Conditioning: Residential and commercial air conditioning systems recorded higher sales with the development of the quality of life, as well as the rising pace of urbanization.

Food and Beverages Growth: The food and beverages industry recorded a massive growth boost with more food processing plants, convenience stores, and restaurants being established. This expansion heightened the demand for commercial refrigeration appliances, thereby boosting compressor production. 2025 and Beyond Forecast: In the future, the South Korean refrigeration compressor industry will continue to expand.

Projected at an estimated CAGR of 2.0% during 2024 to 2034, the industry will increase to USD 2,676.7 million in 2034. Based on this CAGR, the 2025 market size is around USD 2,239.7 million, and around USD 2,730.2 million in 2035.

There are certain factors that are going to impact this growth: Technology Advances: Further advances in compressors technology are expected to produce more efficient and environmentally friendlier products that are in line with global sustainability standards. Export: South Korean manufacturers can venture into new industries based on their improved competitiveness through strategic partnerships to expand exports.

Future Market Insights carried out a comprehensive survey of the South Korean refrigeration compressor industry with regard to its main stakeholders, which include suppliers, manufacturers, retailers, and end-users. It was revealed through the survey that energy efficiency is at the top of the agenda for both buyers and producers and over 70% of the respondents provided a clear yes to using compressors with power-saving features without any reduction in cooling performance.

In addition, the study showed that raw material inflation and supply chain disruptions remain among the largest concerns for manufacturers. Over 65% of manufacturers faced difficulties in sourcing key components due to global supply chain disruptions.

As a result, most companies are diversifying their supplier base and adopting local procurement strategies to make sure they are still in operation even without global inputs. Also, some respondents highlighted strategic collaborations with international brands as a key strategy for overcoming industry challenges and diversifying product offerings.

In South Korea, the refrigeration compressor industry is influenced by several government regulations and mandatory certifications aimed at ensuring product safety, energy efficiency, and environmental compliance. The table below outlines these key policies and certifications:

| Regulation/Certification | Description |

|---|---|

| KC Certification | The Korea Certification (KC) mark is mandatory for electronic devices operating above 30V AC or 42V DC, which includes refrigeration compressors. The certification ensures compliance with Korean safety standards. Depending on the product type, it may require local product testing and, for some categories, factory audits with annual follow-up inspections. |

| Energy Efficiency Rating Labeling System | This mandatory system requires manufacturers to label products with energy efficiency ratings ranging from 1 to 5, based on energy usage and performance. Products failing to meet Minimum Energy Performance Standards (MEPS) are prohibited from production and sale. This program targets various appliances, including those with refrigeration compressors, to promote energy-saving products. |

| High-Efficiency Equipment Certification | A voluntary program recognizing products that meet specific high-efficiency criteria. Certified products can display a high-efficiency mark, encouraging the production and use of energy-saving equipment. This program covers items like pumps and boilers, which may include refrigeration compressors. |

| e-Standby Program | A mandatory reporting system aimed at reducing standby power consumption. Products meeting standby power reduction standards can display an energy-saving label, while those that do not must show a warning label. This program includes office equipment and other appliances, potentially impacting products with refrigeration compressors. |

| KGS Factory Registration | For certain components used in applications like hydrogen refueling stations, additional approvals such as testing according to KS B ISO 19880-3 or a KS certification are required. Components like pressure vessels or entire facilities may need extra safety requirements and permits, which could impact refrigeration compressors used in these settings. |

These regulations and certifications are designed to ensure that refrigeration compressors in South Korea meet stringent safety and efficiency standards, thereby protecting consumers and promoting environmental sustainability.

| 2020 to 2024 (Past Performance) | 2025 to 2035 (Future Outlook) |

|---|---|

| The introduction of inverter-driven compressors and eco-friendly refrigerants gained traction IoT-enabled compressors started emerging but faced slow adoption due to high costs and infrastructure limitations. | IoT-enabled compressors with predictive maintenance and real-time monitoring will see widespread adoption. AI-powered energy optimization solutions will become more common. |

| Governments globally introduced restrictions on HFC-based refrigerants, encouraging manufacturers to shift to low-GWP alternatives. Energy efficiency regulations tightened. | Stricter environmental policies will push further reductions in high-GWP refrigerants. New energy-efficiency benchmarks will become mandatory in multiple regions. |

| The COVID-19 pandemic caused disruptions in supply chains, leading to component shortages and price volatility for raw materials. | Companies will focus on localized production and diversified supplier networks to mitigate risks. Supply chains are expected to stabilize with improved logistics. |

| Korean manufacturers partnered with global brands to strengthen competitiveness, while mid-sized firms increased R&D investments. | Consolidation is likely, with mergers and acquisitions expected. Companies investing in sustainable and high-efficiency solutions will gain an edge. |

| Residential and commercial air conditioning saw steady demand growth. The food retail sector drove refrigeration needs. | Demand will increase due to urbanization, climate change effects, and energy efficiency awareness. Emerging economies will boost demand for refrigeration solutions. |

Based on product type, the market is divided into reciprocating, rotary, scroll, screw, and centrifugal. In South Korea, reciprocating refrigeration compressors are mostly utilized, and the reason is their robust structure, as they offer reliable performance in a diverse array of applications, ranging from residential, and commercial to industrial refrigeration systems. The stable operation under varied conditions provided by reciprocating compressors makes them suitable for uses requiring precise temperature control.

Based on refrigerant type, the market is divided into R410A, R407C, R404A, R134A, R290, R600a, and others. In South Korea, conventional refrigerants like R404A have traditionally found broad application in refrigeration compressors, mostly for lower upfront capital expenditures and a lack of intense regulatory forces.

In addition, more transition towards greener alternatives, including natural refrigerants R290 (propane) and R600a (isobutane) and hydrofluorocarbons (HFCs) with lower global warming potential (GWP), is underway. This change is being driven by global trends toward sustainability and an appreciation of the environmental impact of high-GWP refrigerants.

Based on application, the market is divided into residential, commercial, medical & healthcare, industrial, and transport. The largest industry in South Korea's commercial sector is that of refrigeration compressors.

The growth of the food and beverage industry in this country, which has grown to monumental heights in the last decade, is responsible for the largest share of refrigeration compressors. The expansion of food processing plants, convenience stores, and restaurants has heightened demand for commercial refrigeration, driving compressor production.

LG Electronics(30%)

Overview: LG is an industry leader in the Korean landscape with a broad product range of compressors for residential and commercial use. The firm is reputed to provide innovative and energy-efficient solutions.

Major Strengths: State-of-the-art R&D facilities, strong distribution network, and brand name.

Samsung Electronics(25%)

Overview: Another industry pioneer in emphasis on advanced compressor technologies utilized in air-conditioning and refrigeration applications.

Key Strengths: Highly advanced technology, extensive global coverage, and smart home system compatibility.

Danfoss Korea (15%)

Description: Danfoss, the world leader in HVACR solutions, has a broad presence in Korea. It's a leading player in energy-saving and environmentally friendly compressor technology.

Key Strengths: Expertise in environment-friendly refrigerants, excellent after-sales service, and a large product range.

Emerson Electric (Copeland)(10%)

Overview: Emerson's Copeland brand has a name for scroll and reciprocating compressors which are widely used in commercial refrigeration.

Key Strengths: Exceptional reliability, global brand reputation, and innovation focus.

Mitsubishi Electric Korea(8%)

Overview: Mitsubishi Electric is a company with a wide selection of compressors for residential and commercial use, emphasizing precision and efficiency.

Key Strengths: Cutting-edge technology, quality emphasis, and global expertise.

Other Players (Local and Foreign)(12%)

Overview: These include smaller local players and other overseas brands like Panasonic, Hitachi, and Bitzer.

Key Strengths: Low-cost aggressive pricing, specialty product solutions, and local expertise.

The industry for refrigeration compressors is highly driven by macroeconomic conditions including GDP growth, industrial production, consumer spending, and regulatory policy. South Korea’s economic growth and urbanization have significantly boosted demand for refrigeration across various industries. Rising disposable income and higher standards of living have driven residential and commercial refrigeration system sales, whereas industrial and medical uses are further expanding.

Global trade policy and supply chain instability have been the main drivers of the industry. The COVID-19 pandemic initially caused fluctuations in raw material prices and component availability, but currently, the industry has adapted through local sourcing initiatives and technical advancements. Moreover, increasing energy prices and strict environmental regulations compel manufacturers to design energy-efficient and environmentally friendly compressors with low global warming potential (GWP) refrigerants.

Expansion into Eco-Friendly Refrigerants

With South Korea coordinating its policy with international sustainability objectives, the demand for low-GWP refrigerants like R290 (propane) and CO₂-based systems is increasing. Firms investing in compressors that support natural refrigerants can achieve a competitive advantage. Government incentives for green cooling solutions also abet this transition.

IoT-Enabled and AI-Powered Compressors

Smart refrigeration systems using IoT and AI for real-time monitoring, predictive maintenance, and energy efficiency are also gaining prominence. Investments in cloud-based compressor management systems can increase operating efficiency and cost savings for commercial and industrial consumers.

Localization of Supply Chain

Disruptions to global supply chains have revealed weaknesses in sourcing compressor components. Diversifying the supplier base and having local manufacturing bases in South Korea can minimize foreign dependence and lead times.

With respect to product type, the segment is classified into reciprocating, rotary, scroll, screw, and centrifugal.

With respect to refrigerant type, the segment is classified into R410A, R407C, R404A, R134A, R290, R600a, and others.

In terms of application outlook, the segment is divided into residential, commercial, medical & healthcare, industrial, and transportation.

In terms of province, the industry is segmented into South Gyeongsang, North Jeolla, South Jeolla, and Jeju.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Refrigerant Type, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Refrigerant Type, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Refrigerant Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Refrigerant Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Refrigerant Type, 2019 to 2034

Table 18: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Refrigerant Type, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 21: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Refrigerant Type, 2019 to 2034

Table 24: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Refrigerant Type, 2019 to 2034

Table 25: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 26: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 27: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Refrigerant Type, 2019 to 2034

Table 30: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Refrigerant Type, 2019 to 2034

Table 31: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 32: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Table 33: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Refrigerant Type, 2019 to 2034

Table 36: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Refrigerant Type, 2019 to 2034

Table 37: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Refrigerant Type, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Refrigerant Type, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Units) Analysis by Refrigerant Type, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Refrigerant Type, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Refrigerant Type, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Refrigerant Type, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 26: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Refrigerant Type, 2024 to 2034

Figure 27: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 28: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 29: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 30: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Refrigerant Type, 2019 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Refrigerant Type, 2019 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Refrigerant Type, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Refrigerant Type, 2024 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Attractiveness by Refrigerant Type, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 43: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 44: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Refrigerant Type, 2024 to 2034

Figure 45: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 46: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 47: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 48: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 49: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 50: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Refrigerant Type, 2019 to 2034

Figure 51: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Refrigerant Type, 2019 to 2034

Figure 52: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Refrigerant Type, 2024 to 2034

Figure 53: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Refrigerant Type, 2024 to 2034

Figure 54: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Attractiveness by Refrigerant Type, 2024 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 61: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Refrigerant Type, 2024 to 2034

Figure 63: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 64: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 65: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 66: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 67: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 68: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Refrigerant Type, 2019 to 2034

Figure 69: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Refrigerant Type, 2019 to 2034

Figure 70: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Refrigerant Type, 2024 to 2034

Figure 71: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Refrigerant Type, 2024 to 2034

Figure 72: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 73: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 74: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 75: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 76: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 77: South Jeolla Industry Analysis and Outlook Attractiveness by Refrigerant Type, 2024 to 2034

Figure 78: South Jeolla Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 79: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: Jeju Industry Analysis and Outlook Value (US$ Million) by Refrigerant Type, 2024 to 2034

Figure 81: Jeju Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 82: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 83: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 84: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 85: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 86: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Refrigerant Type, 2019 to 2034

Figure 87: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Refrigerant Type, 2019 to 2034

Figure 88: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Refrigerant Type, 2024 to 2034

Figure 89: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Refrigerant Type, 2024 to 2034

Figure 90: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 91: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 92: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 93: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 94: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 95: Jeju Industry Analysis and Outlook Attractiveness by Refrigerant Type, 2024 to 2034

Figure 96: Jeju Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Figure 97: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 98: Rest of Industry Analysis and Outlook Value (US$ Million) by Refrigerant Type, 2024 to 2034

Figure 99: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2024 to 2034

Figure 100: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 102: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Refrigerant Type, 2019 to 2034

Figure 105: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Refrigerant Type, 2019 to 2034

Figure 106: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Refrigerant Type, 2024 to 2034

Figure 107: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Refrigerant Type, 2024 to 2034

Figure 108: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 109: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Application, 2019 to 2034

Figure 110: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 111: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 112: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 113: Rest of Industry Analysis and Outlook Attractiveness by Refrigerant Type, 2024 to 2034

Figure 114: Rest of Industry Analysis and Outlook Attractiveness by Application, 2024 to 2034

Rising demand in food processing and logistics due to urbanization and e-commerce growth.

The most prevalent is the reciprocating compressor because of its reliability, efficiency, and capability to operate with fluctuating load conditions.

Legislation favoring low-GWP refrigerants and more stringent energy efficiency regulations are encouraging businesses to switch to more environmentally friendly compressor technologies.

Real-time monitoring & predictive maintenance reduce downtime and repair costs.

The food and beverage, healthcare, pharmaceutical, and logistics sectors rely on them for temperature-controlled storage and transport.

Explore Operational Equipment Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.