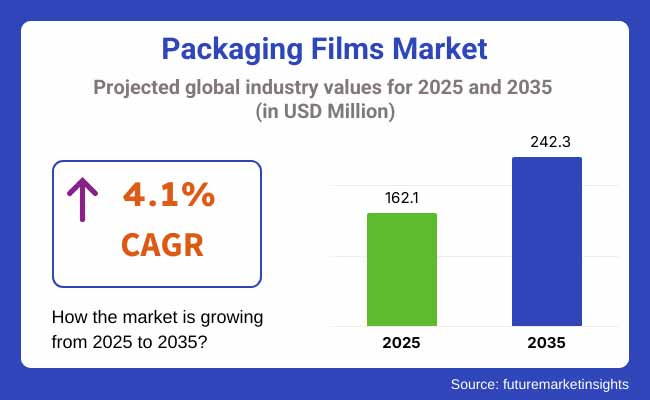

The global packaging films market, valued at USD 162.1 million in 2025, is anticipated to witness steady growth, reaching a valuation of USD 242.3 million by 2035, growing at a CAGR of 4.1% over the forecast period from 2025 to 2035. Revenue generated from packaging films in 2024 stood at USD 155.7 million, highlighting stable demand momentum driven by increasing usage across diverse industries including food and beverage, pharmaceuticals, consumer electronics, and personal care.

Demand is particularly robust in food packaging, driven by the industry's continual push toward shelf-life extension, hygiene standards, and product visibility. As consumer preferences increasingly lean towards convenience foods, the adoption of flexible and transparent packaging films such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and biodegradable films continues to grow. Technological advancements have significantly enhanced film performance, incorporating superior barrier properties, moisture resistance, and sustainability credentials.

Sustainability remains a pivotal growth driver in the packaging films industry. With increasing regulatory pressures and consumer demand for eco-friendly alternatives, biodegradable and recyclable film variants are rapidly gaining prominence. Brands and manufacturers, such as Amcor, Berry Global, and Sealed Air, have substantially increased R&D investments to develop innovative, sustainable packaging films that comply with stringent environmental regulations, particularly within the European Union and North America.

According to Ron Delia, CEO of Amcor, a global leader in packaging solutions,"The future of packaging films revolves around sustainable innovation. By continuously developing recyclable, reusable, and biodegradable film technologies, we're responding proactively to consumer demands for environmentally responsible packaging. Our investments in high-performance, sustainable films position us to lead industry growth while significantly reducing environmental impact over the coming decade."

Asia Pacific leads the global market, supported by rising disposable income, urbanization, and the expansion of organized retail sectors, especially in emerging economies like India, China, and Southeast Asian countries. Packaging film consumption in the Asia Pacific region is projected to outpace the global average, driven by dynamic growth in eCommerce, food delivery services, and pharmaceutical packaging needs.

Technological innovations, such as smart films with integrated RFID tracking and active packaging films providing antimicrobial and antioxidant properties, represent significant future growth areas. Brands are increasingly integrating these advanced functionalities to enhance supply-chain efficiency, reduce product spoilage, and meet consumer expectations for freshness and safety.

The below table presents the expected CAGR for the global packaging films market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.3% (2024 to 2034) |

| H1 | 3.1% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.3% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.1% in the first half and remain relatively moderate at 5.1% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS while in the second half (H2), the market witnessed an increase of 80 BPS.

Bags and sacks are projected to dominate the packaging films market by 2025, holding a market share exceeding 35%. Their widespread use across food, beverage, homecare, retail, and e-commerce sectors is attributed to their lightweight nature, cost-effectiveness, and strong barrier properties that protect products from contamination, moisture, and UV exposure. The increasing demand for resealable and biodegradable packaging solutions is driving innovation in eco-friendly film-based bags and sacks, further strengthening their market position.

Polyethylene is estimated to account for 42% of the packaging films market by 2025. Its dominance is due to its flexibility, affordability, and durability, making it widely used in food, beverage, personal care, and industrial applications. PE films offer excellent moisture resistance, making them ideal for perishable food packaging.

Their high tensile strength ensures product protection during transportation and storage. Moreover, PE films are lightweight and recyclable, aligning with the rising demand for sustainable packaging solutions. The availability of multiple PE variants, such as LDPE, HDPE, and LLDPE, enhances their versatility across industries.

Flexible Packaging is in Demand from Food & Beverage Industry

Food and beverage sectors consume massive quantities of packaging films, normally for barrier, shelf life extension, and lightweight packing uses. Consumption of food is progressively moving towards being activated on-the-go with ready-to-eat food and pre-packaged snacks. With growing demand, there is a trend towards the utilization of sustainable and flexible packaging films.

Flexible films can be polyethylene (PE), polypropylene (PP), and biodegradable plastics, among others, one of whose functions is to maintain freshness in food by keeping out moisture, oxygen, and light. At the same time, increasing popularity in e-commerce grocery services has generated a demand for tamper-proof as well as durable packaging films to ensure the safety of the food being shipped. Finally, businesses are making huge efforts to develop green innovations such as recyclable and compostable packing films.

Growing Acceptance of Biodegradable and Environmentally Friendly Packaging Films

The transition to green packaging has been responsible for the consistent increase in the consumption of recyclable and biodegradable packaging films. Governments pass into legislation stringent regulations on the manufacture and use of single-use plastic, forcing plastic manufacturers to look for environmentally friendly film alternatives.

Such films include films produced from PLA (polylactic acid) and PHA (polyhydroxyalkanoates) and the majority of cellulosic films that biodegrade naturally without polluting the environment. Apart from this, the big companies are also investing in circular economy options in plastic film recycling and reuse to reduce the environmental footprint.

Increasingly, consumers are opting for brands with green packaging solutions; thus, the majority of big companies are investing in biodegradable and recyclable plastic film packaging. Thus, the demand for these packaging green films is constantly increasing in industries such as food, pharmaceuticals, and consumer goods.

Exorbitant Price of Superior and Eco-friendly Packaging Films

Green and performance packing films have a clear advantage but are costly than conventional plastic film. Production of biodegradable, compostable, and multi-layer films calls for advanced technology, special raw materials, and strict adherence to regulations, leading to production costs.

Small- and medium-scale enterprises would be unable to execute green packaging technologies due to cost. In most areas, recycling and processing facilities for biodegradable films are in the infancy stage, causing challenges in creating economically viable mass production. Until the time that technological progress and economy of scale achieve a downward influence on cost, the premium cost will remain a main barrier towards having broad acceptance.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Eco-Friendly Materials | Investment in biodegradable, recyclable, and compostable films will curb plastic waste and adhere to international environmental regulations. |

| Barrier Protection & Shelf Life Extension | Increased moisture, oxygen, and UV resistance will enhance food, pharmaceutical, and consumer goods packaging by increasing product freshness. |

| Customization & Industry-Specific Solutions | Creating multi-layer, heat-sealable, and high-strength films will serve various industries such as food, healthcare, and industrial packaging. |

| Lightweight & Cost-Effective Production | Streamlining material composition to create lightweight but resilient films will reduce manufacturing and shipping costs without compromising product protection. |

| Smart & High-Performance Packaging | Intelligent packaging options such as QR codes, RFID monitoring, and antimicrobial coverings will facilitate higher consumer involvement and product protection. |

The global packaging films market achieved a CAGR of 3.2% in the historical period of 2020 to 2024. Overall, the packaging films market performed well since it grew positively and reached USD 155.7 million in 2024 from USD 136.1 million in 2020.

The packaging films market experienced steady growth from 2020 to 2024, driven by increasing demand for flexible, lightweight, and durable packaging solutions across industries such as food & beverages, pharmaceuticals, personal care, and industrial goods.

The shift toward convenience packaging, coupled with advancements in high-barrier films that enhance product shelf life, contributed to market expansion. Additionally, rising e-commerce activities and the need for tamper-proof and protective packaging further fueled demand for packaging films.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Material Trends | Controlled by polyethylene (PE), polypropylene (PP), PET, and PVC films for flexible packaging. |

| Regulatory Environment | Adherence to FDA, EU, and local food safety and packaging waste management regulations. |

| Consumer Demand | Strong demand from food & beverage, pharmaceutical, and personal care sectors for light and strong films. |

| Technological Developments | Advancements in multi-layer barrier films, antimicrobial films, and oxygen-scavenging technologies. |

| Sustainability Initiatives | More emphasis on minimizing plastic waste, improving recyclability, and embracing bio-based polymers. |

| Material Trends | Controlled by polyethylene (PE), polypropylene (PP), PET, and PVC films for flexible packaging. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Material Trends | Transition to biodegradable, compostable, and recyclable films to aid circular economy approaches. |

| Regulatory Environment | More stringent rules on single-use plastics, carbon footprint, and adoption of eco-friendly materials. |

| Consumer Demand | Growing demand for recyclable, plant-based, and smart packaging films for sustainability and ease. |

| Technological Developments | Increased development of nanotechnology-based films, self-healing surfaces, and AI-based supply chain monitoring in packaging. |

| Sustainability Initiatives | Robust drive toward zero-waste films, water-soluble packaging materials, and completely compostable packaging solutions. |

| Material Trends | Transition to biodegradable, compostable, and recyclable films to aid circular economy approaches. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Product Availability & Convenience |

|

| Cost & Pricing |

|

| Performance (Barrier Protection, Durability, Shelf Life Extension) |

|

| Regulatory Compliance & Safety |

|

| Customization & Smart Technology |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Product Availability & Convenience |

|

| Cost & Pricing |

|

| Performance (Barrier Protection, Durability, Shelf Life Extension) |

|

| Regulatory Compliance & Safety |

|

| Customization & Smart Technology |

|

Between 2025 and 2035, the market is expected to grow due to increasing emphasis on sustainable and recyclable packaging materials. The adoption of biodegradable, compostable, and mono-material films will rise as industries seek eco-friendly alternatives to traditional plastic films.

Additionally, innovations in smart and active packaging technologies, such as antimicrobial films and RFID-enabled tracking, will enhance product safety and supply chain efficiency. The expansion of food delivery services, pharmaceuticals, and high-performance industrial packaging will further drive demand for advanced packaging film solutions.

Tier 1 companies comprise market leaders capturing significant market share in packaging films market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Berry Global, Mondi Group, Ampac Holdings.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include LLC, Huhtamaki Oyj, Smurfit Kappa, WestRock Company, Amcor Plc, Sealed Air Corp, Winpak, Novolex, Printpack.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Regions | 2019 to 2024 (Past Trends) |

|---|---|

| North America | High demand from food, beverage, and pharmaceutical industries for flexible packaging. |

| Latin America | Moderate expansion fueled by growing retail and processed foods sectors. |

| Europe | Dominant market because of stringent plastic reduction measures and emphasis on the circular economy. |

| Middle East & Africa | Growing use in food, agriculture, and consumer packaging. |

| Asia Pacific | Rising fastest market with fast industrialization and booming e-commerce industry. |

| Regions | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Growing use of biodegradable and recyclable films to achieve sustainability objectives. |

| Latin America | Growing investments in environmentally friendly and price-efficient packaging options. |

| Europe | Increased application of compostable and bio-based films for sustainable packaging. |

| Middle East & Africa | High-barrier and intelligent packaging films growth to increase shelf life. |

| Asia Pacific | Capacity expansion in manufacturing of sophisticated multi-layer films for high-performance packaging. |

The section below covers the future forecast for the packaging films market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3% through 2035. In Europe, Spain is projected to witness a CAGR of 3.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.0% |

| Germany | 2.6% |

| China | 5.0% |

| UK | 2.5% |

| Spain | 3.7% |

| India | 5.2% |

| Canada | 2.8% |

With the remarkable surge in USA online grocery purchasing and e-commerce, demand will need to be met by superior-quality packaging films. Protective, rugged, and abrasion-resistant packaging films are sought after heavily because consumers increasingly purchase foodstuffs, beverages, and consumer goods online in order to preserve product integrity during transport.

With consumers looking to transport goods at lower cost, the demand is heightened for tamper-proof, light, and custom-made packaging films. For freshness preservation of food items and for protection of the quality of food products, meal kit delivery services such as Blue Apron and HelloFresh have also seen growing demand for food-grade recyclable and biodegradable packaging films.

Germany has historically been at the forefront of green packaging innovations due to its effective regulatory framework for plastic waste by its government and sound recycling culture. The German Packaging Act (VerpackG) has more stringent recycling rates and encourages the phasing in of businesses towards biodegradable and recyclable films.

Therefore, large retailers and producers are currently substituting their conventional plastic packaging with sustainable alternatives such as compostable and fibre-based films. At the same time, Germany's emphasis on circular economy is prioritizing the recycling alternatives of plastic films with minimal environmental impact. Such green measures, coupled with consumer preference, are working toward the establishment of green packaging films in the German market.

The Packaging Films Market is experiencing robust growth, driven by the rising demand for flexible, lightweight, and durable packaging solutions across industries such as food & beverage, pharmaceuticals, personal care, and industrial goods. Packaging films, made from materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and biodegradable polymers, offer barrier protection, extended shelf life, and sustainability benefits.

With increasing consumer preference for eco-friendly and recyclable packaging, manufacturers are focusing on biodegradable, compostable, and high-barrier packaging films. Additionally, advancements in nanotechnology, multilayer films, and smart packaging solutions are reshaping competition in the market. The growth of e-commerce, convenience foods, and strict food safety regulations is further accelerating the adoption of high-performance packaging films.

Key Developments in Packaging Films Market

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor PLC | 15-20% |

| Berry Global Group | 10-15% |

| Sealed Air Corporation | 8-12% |

| Mondi Group | 6-10% |

| Coveris Holdings S.A. | 5-8% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor PLC | Produces high-barrier, recyclable, and biodegradable packaging films, with a focus on food safety and shelf-life extension. |

| Berry Global Group | Specializes in customized flexible packaging films, including stretch, shrink, and multilayer barrier films for various industries. |

| Sealed Air Corporation | Develops vacuum-sealed, active, and smart packaging films that help in preserving freshness and reducing food waste. |

| Mondi Group | Offers eco-friendly and sustainable flexible packaging films, including compostable and paper-based laminates. |

| Coveris Holdings S.A. | Manufactures lightweight, high-performance packaging films, emphasizing cost efficiency and recyclability. |

Key Company Insights

Amcor PLC (15%-20%)

Amcor is a market leader in high-barrier and recyclable packaging films, focusing on food, beverage, and pharmaceutical applications. The company is investing in sustainable materials and digital printing technologies to meet growing environmental concerns.

Berry Global Group (10%-15%)

Berry Global specializes in stretch and shrink films, catering to industrial, retail, and food packaging applications. The company is advancing lightweight, durable, and recyclable packaging solutions to enhance product performance.

Sealed Air Corporation (8%-12%)

Sealed Air is known for its vacuum-sealed and active packaging films, designed to prolong shelf life and maintain food freshness. The company also focuses on smart packaging solutions that integrate sensor-based freshness indicators.

Mondi Group (6%-10%)

Mondi provides sustainable packaging films, including biodegradable, compostable, and recyclable options. It is actively developing barrier coatings and lightweight materials for high-performance food and pharmaceutical packaging.

Coveris Holdings S.A. (5%-8%)

Coveris specializes in cost-effective, flexible packaging films that balance performance, sustainability, and durability. The company is investing in post-consumer recycled (PCR) materials to enhance its circular economy strategy.

Other Key Players (30-40% Combined)

Several smaller yet significant players contribute to the Packaging Films Market, offering innovative and specialized solutions:

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 162.1 million |

| Projected Industry Size (2035) | USD 242.3 million |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million; Billion square meters of film for volume |

| Material Types | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polyamide (PA), Ethyl Vinyl Alcohol (EVOH), Polyvinylidene Chloride (PVDC), Bioplastics, Others |

| Product Types | Pouches, Bags & Sacks, Tubes, Liners, Sachets & Stick Packs, Tapes & Labels, Wraps/Rolls |

| End Uses | Food (Meat, Seafood, and Poultry; Ready to Eat Meals; Dairy Products; Bakery and Confectionery; Other Food Products), Beverages, Homecare Products, Personal Care Products, Healthcare Products, Electronics & Electrical, Other Industrial Goods |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Key Players | Berry Global, Mondi Group, Ampac Holdings, LLC, Huhtamaki Oyj, Smurfit Kappa, WestRock Company, Amcor Plc, Sealed Air Corp, Winpak, Novolex |

| Additional Attributes | Emphasis on lightweighting, recyclability, and barrier innovation is redefining competitive strategies in the flexible packaging industry. High-performance multilayer films and increased use in e-commerce logistics are accelerating demand. |

| Customization and Pricing | Customization and Pricing Available on Request |

By material type, market divided into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), polyamide (PA), ethyl vinyl alcohol (EVOH), polyvinylidene chloride (PVDC), bioplastics, and others.

By product type, market divided into Pouches, Bags & Sacks, Tubes, Liners, Sachets & Stick Packs, Tapes & Labels, Wraps/Rolls.

By end use, market divided into food, beverages, homecare products, personal care products, healthcare products, electronics & electrical, other industrial goods. Food further divided into meat, seafood, and poultry; ready to eat meals; dairy products; bakery and confectionery; other food products.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Tonnes) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Tonnes) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Tonnes) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Latin America Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Europe Market Volume (Tonnes) Forecast by Material Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Europe Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tonnes) Forecast by Material Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: MEA Market Volume (Tonnes) Forecast by Material Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: MEA Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (Tonnes) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Tonnes) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Tonnes) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: North America Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tonnes) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 62: Latin America Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Europe Market Volume (Tonnes) Analysis by Material Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 86: Europe Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tonnes) Analysis by Material Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: MEA Market Volume (Tonnes) Analysis by Material Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 134: MEA Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (Tonnes) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

The global packaging films industry is projected to witness CAGR of 4.1% between 2025.

The global packaging films industry stood at 155.7 million in 2024.

Global packaging films industry is anticipated to reach USD 242.3 million by 2035 end.

East Asia is set to record a CAGR of 5.2% in assessment period.

The key players operating in the global packaging films industry include Berry Global, Mondi Group, Ampac Holdings.

Explore Plastic Packaging Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.